Practice for Profit - Mathematics to the rescue

Mathematics is a lovely endeavor. It is straightforward, honest and without complications. Life, on the other hand, is filled with un-asked for permutations that drive us up walls, which when fully considered using Newtonian physics is a practical impossibility.

Mathematics is a lovely endeavor. It is straightforward, honest and without complications. Life, on the other hand, is filled with un-asked for permutations that drive us up walls, which when fully considered using Newtonian physics is a practical impossibility.

If you have even read this far, I applaud you. There is a point here, I assure you!

The two great issues in all our minds today are vaccination schedules and fees. I'm not sure what form the vaccination schedules of 2006 and beyond will take, but I can assure you that fees will forever be on your minds. Therefore, I want to make a small contribution to short circuit the chaos associated with fees.

Veterinarians are in the same position as everyone else in that they cannot directly access their needs. People do not want to have to buy quarter-inch drills when their object is a quarter-inch hole. However, there is no getting the one without the other.

So, applying the principles of mathematics, I have discovered the relationship between your average transaction fee (gross revenues divided by the number of invoices to get there) and your final take-home salary!

This may not rank up there with E=MC2, but what does?

Here it is .... Get ready! In an inflation-free economy ...

Increasing your ATF $1 increases your take-home pay by $2,250.

Wow! You mean that if I want to take home $9,000 more, I just need to increase my ATF by just $4?

You mean that if I want to take home $18,000 more, I just need to increase my ATF by only $8? Shucks! I can do that!

Yep! That's it! No kidding! And ... what good client cannot afford $8 to help you afford a better lifestyle?

Typically, a hospital produces 5,000 transactions for the first veterinarian on the staff. That is composed of 80 percent (4,000) client visits and 20 percent (1,000) over-the-counter transactions for supplies, boarding or grooming and diets. This can vary with the amount of diets and boarding done. You can add 4,000 transactions for each additional associate.

A dollar increase in the average of 5,000 transactions amounts to $5,000 buckaroos. In a 33 percent net practice, that might erroneously be thought to lead to ($5,000 x 0.33) or just $1,650 net dollars, which in our usual tax bracket nets about $1,000.

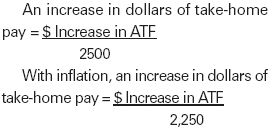

However, increases in ATF are usually a combination of fee increases and additional services performed (thoroughness) per pet. Pure fee increases have no additional cost and are 100 percent additional profit falling to the bottom line. Service increases are only 50-percent profit as you have additional staff and drug costs for the additional services. The typical result of a $5,000 fee/service amalgam is 75-percent profit on each incremental dollar or 5,000 x .75 = $3,750. Now, we have our great state and federal system entering the picture and whisking away some 30 percent of this increase, leaving some $2,500 in take-home for each dollar increase in ATF.

You might ask, ... "What is the relationship of my examination fee to my take-home pay?" If I raise my examination fee by $4, won't I achieve a similar result?

That answer is clear and clearer. First, the typical veterinarian does not have the intestinal fortitude needed to raise an examination fee $2 at one time, let alone $4, and unfortunately, you charge an examination fee in only half or even less of your transactions.

True ... half of 5,000 transactions will yield 2,500 x $4 increase or $10,000 dollars.

It is also true that would be $10,000 dropping to the bottom line. After taxes, that leaves you $6,500, but what do you do for Act Two? Is it worth increasing your client's perception of expensive medicine caused by raising your most exposed and shopped fee?

Well, you say, "So what!" I need to take home another $30,000 in the next year, but increasing my examination fee $13 ($30,000/2,250) is sure to sink my practice.

No problem! Just stop thinking about office visit/examination fee and think about average transaction fee (ATF.) ATF is sort of, kind of, almost always, more or less, usually and most often about three times your office visit/exam fee anyway!

To get the same $30,000 increase, you need to increase all of your fees (ATF) by a much smaller percentage. If your ATF is currently $90, a $12 ATF increase would only be a 13-percent increase, and you could even sneak up on that by increasing 1 percent per month which, using compounding would get you to 13.2 percent in just 12 months.

Whoops! One little detail: Inflation, in the costs of running a small animal practice was published (AVMA Jan 2005) as 9.3 percent, leaves you 13.2 less 9.3 or 3.9-percent increase. So, a 1.42-percent increase in ATF per month to sneak up on an ATF that would net you that slippery and elusive $30,000. Of course, you could just increase your ATF by 13 percent right now and then keep your position by increasing fees thereafter by 1 percent per month.

This tactic will never hurt a practice in an area where local demographics show an average family income of $55,000 or more with a five-year projection of household growth of 5 percent or more. You will lose at least three clients, but that's the price you pay for being a businessperson and a professional earning $30,000 more next year!