Don't Forgo Your Financial Game Plan

Do you have a written financial plan? If so, new research shows that you also are likely to have several other healthy financial habits.

For some people, planning is everything: to-do lists, weekly grocery lists, meal plans, outfits, vacation planning, financial planning, you name it. For others, planning simply doesn’t happen — and this can be devastating come retirement time.

According to new research from Charles Schwab, only one in four Americans actually has a written financial plan.

By using data from 1,000 Americans who participated in its 2018 Modern Wealth Index assessment, Charles Schwab found that those who plan their finances are more likely to have a higher overall Modern Wealth Index score, meaning they also save regularly and manage their debt effectively.

“When we look at the top 10 percent of overall performers in our Modern Wealth Index, there’s a consistent theme that they’re diligent planners — three in four say they have a written financial plan,” Terri Kallsen, executive vice president and head of Schwab Investor Services, said.

Are you a diligent planner when it comes to your finances? If so, then you’re more likely to make these other smart money moves, too.

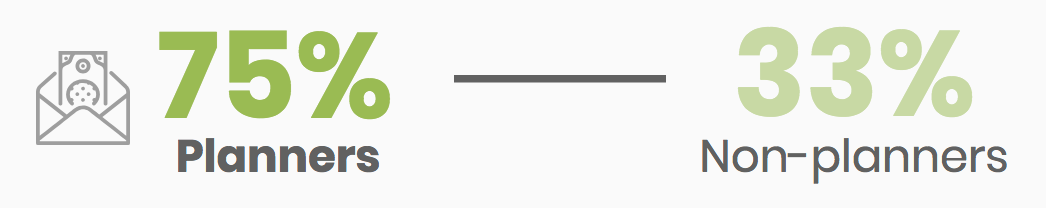

1. Pay your bills and save each month.

2. Have an emergency fund.

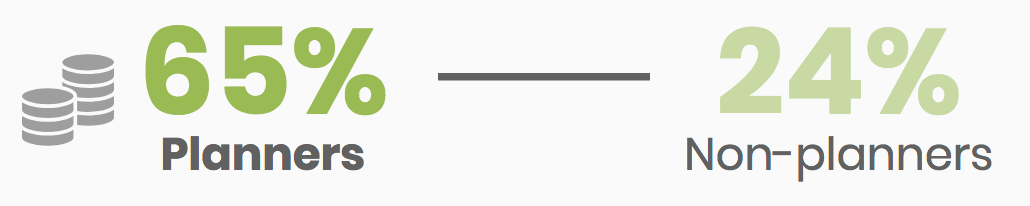

3. Invest in life insurance.

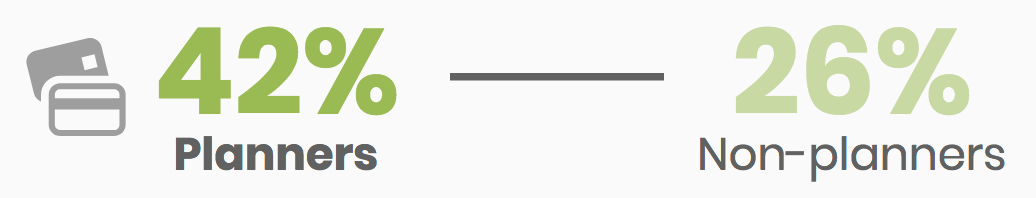

4. Never carry a credit card balance.

5. Feel financially stable.

Data also revealed that 45 percent of those without a formal written financial plan think they don’t have enough money to merit one. But the idea that financial planning is only for those flush with cash is one of the biggest and most damaging misconceptions Americans have.

“We believe every American deserves a financial plan,” Joe Vietri, senior vice president and head of Schwab’s retail branch network, said, “regardless of how much money they have today.”

Have you forgone your financial plan? There’s no reason you can’t take control of your personal financial planning process today. And if you don’t know where to start, there are always financial advisors available who are familiar with the needs of those in the veterinary profession.

“Planning is critical to achieving any goal,” Kellsen said. “It’s like establishing an exercise regimen to get in shape — we need to take the same approach to keep our finances in good health and on track.”