Millennials See $1 Million in Savings as Impossible Dream, Study Finds

A new report says Millennials lack confidence in the market and in their ability to save an adequate amount for retirement.

A recent survey finds most millennials don’t think they’ll ever be able to save $1 million for retirement, even though experts say it’s easily do-able for savers who start early.

A new study by Wells Fargo found 60% of millennials have already started saving for retirement, while 4 in 10 haven’t. The study showed that 64% of those who aren’t saving for retirement state they “don’t earn enough to save.”

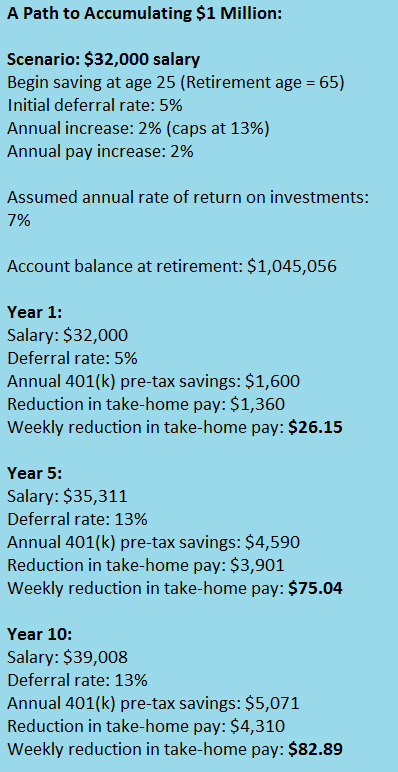

“Millennials may not realize that if they start saving consistently by their mid-twenties — and stay invested for the duration of their working years — they will likely accumulate $1 million by the time they retire,” said Joe Ready, director of institutional retirement and trust for Wells Fargo.

The study found that about one-third (34%) of millennials have student loan debt, with a median debt load of $19,978. Seventy-five percent of those with student loans say their debt is “unmanageable.” And yet 70% of this group are still saving for retirement, averaging 5.5%.

Eight out of 10 millennials believe that saving towards retirement is a necessary element in becoming a “financial adult.” Seeing those who are already comfortable in their retirement makes 82% of millennials want to start saving more towards their own retirement.

In addition, survey respondents said matching funds from employers (18%) and the knowledge that beginning to save early would increase their final nest egg size (21%) helped to motivate them to start saving.

Still, nearly 60% of millennials said they are uncomfortable investing their money in the current economy, while half fearing they will lose their retirement savings in the stock market.

“The fact that half of millennials have a fear of losing their savings in the market concerns me because being invested in the market at this age is only going to benefit this generation for the future,” Ready said. “The market has continued to generate returns for the long-term investor, and it is absolutely critical that younger people recognize this.”

Data source: Fidelity.