Veterinary debt-to-income ratios: What would happen in a recession?

Numerous factors could jeopardize efforts to restore sustainability.

In the April Eye on Economics column, “Headed in the right DIR-ection,” we looked at the current state of new veterinarians' debt-to-income ratio (DIR) as well as the direction it may be heading if action is not soon taken. We provided four main goals aimed at reducing the debt-to-income ratio-goals that shared responsibility among students, veterinary colleges, policymakers (via public policy changes) and practice owners. These four goals sought to eliminate the excessive debt of students, eliminate the interest on student loans while students are in school, reduce tuition costs by 10 percent and increase starting salaries by 10 percent to reduce the DIR from the current 2.1:1 to 1.38:1.

The overarching goal of reducing the DIR from 2:1 to 1.4:1 is ambitious under the best of conditions, but what happens if conditions are less than ideal? Without considering the potential impact of adverse events that negatively affect strategies to reduce the DIR, those involved in the effort may not be prepared for missing the 1.4:1 target after a sustained effort. Because the economy is likely nearing the end of an expansionary period, the relevant question to ask is: What will be the consequences of a new recession? Likewise, suppose schools continue to increase seats at the historical level of 2 percent per year, or new veterinary colleges are opened. What, then, are the consequences?

What is a recession?

In general, a recession is marked by a contraction in a country's gross domestic product (GDP) for two consecutive quarters. During a recession the economy takes a downturn, trade and production are reduced, and consumers curtail expenditures. Often this is quickly followed by joblessness and lowered interest rates as policymakers take action to stimulate the economy. So how does this affect the DIR?

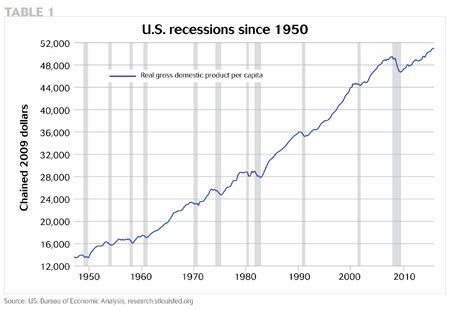

Over the last seven decades, the U.S. economy has experienced contractions approximately every 5.5 years. Table 1 shows real GDP per capita in the United States with the gray bars representing recessions.

As we have previously noted, since the last recession we have had more than 80 months of economic expansion and thus the probability of another recession increases with each passing month. Since the last recession occurred in 2009, it is not unlikely that the U.S. economy could experience another contraction on any given day. Unfortunately, the veterinary services industry is not devoid of the impact and implications of a recession.

A recession would affect the DIR of new veterinarians in two ways. First, the recession will adversely affect state budgets and the funds states allocate to state universities. These funding shortfalls will be added to tuition and the colleges will be forced to cut their teaching budget, raise tuition or increase enrollment. Because colleges have been confronted with this declining funding scenario for more than two decades, the evidence is that enrollment and tuition will increase. The result will be an increase in the rate of growth in student debt.

Second, as the economy contracts, the reduction in consumer expenditures will cause the demand for veterinary services to decline. The reduced demand for veterinary services will lead to a reduction in the demand for new veterinarians and this, in turn, will lead to a decline in new veterinarians' starting salaries.

The increase in debt and decline in starting salaries associated with an economic downturn will cause a spike in the DIR. And once the state governments have cut funding, history suggests that when the economy returns to trend growth, schools will not return to previous funding levels. Thus the number of seats and the level of tuition will return to trend growth, but from a higher point. This effect is known as “ratcheting up” and causes the DIR, which is already trending upward, to make a noticeable jump during each recessionary period.

The ratcheting up of the DIR that will occur in a recession will reduce the effectiveness of the four goals in achieving the desired reduction in the DIR.

The projected impact

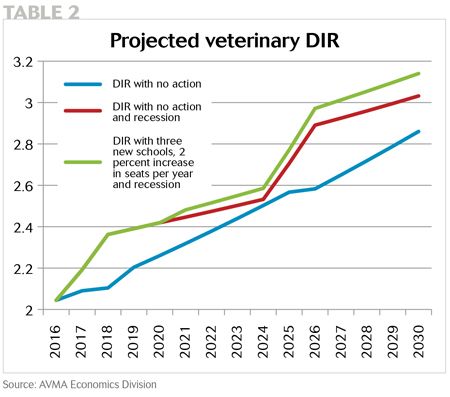

In Table 2, we estimate the DIR using three potential scenarios. In the first scenario we estimate the projected DIR if no action is taken to reduce the current rate of growth. In the second scenario we estimate the path of the DIR if no action is taken and a recession occurs in mid-2017. Finally, the third scenario considers the impact on the DIR of a near-term recession combined with the effect of adding three new veterinary colleges along with a return to the trend growth rate in the number of seats of 2 percent per annum.

If no immediate action is taken to stem the growth and reduce the DIR, these adverse economic events will further exacerbate the currently high 2:1 DIR to a level of over 3.1:1 by 2030. Keep in mind that the DIR is the mean debt-to-income ratio of a constant cohort and thus the range of individual DIRs could be as high as 6:1 for a large portion of the new veterinarians by 2030. Those individuals will have a negative return on their veterinary education and the supply chain for veterinary services may well be compromised.

The current level of growth in the DIR for veterinary graduates (and all other professionals) is unsustainable. As the DIR rises, the impact on the supply of applicants and veterinarians will become clearer. The profession can wait for this clearer indication or take immediate action. Our take? Short-term strategies must be employed immediately while the profession seeks longer-term solutions. Thankfully, the conversation has started and the profession has begun to identify strategies, recession or not, to stabilize its financial health.

Dr. Bridgette Bain is an analyst in the AVMA's Veterinary Economics Division. Dr. Michael Dicks is director of the division.