Maintain your stride during the recession (sponsored by Intervet/Schering-Plough Animal Health)

Consultant, practitioners offer their top economic strategies.

Tough times often call for tough love.

And that's just what it's going to take for equine practice owners who want to avoid getting crushed in the tightening grip of this recession. If you haven't done so already, it's high time to adopt a tough-love policy—both toward your practice's financial procedures and toward those clients who are lax about paying for your services.

And what about your very best clients? This is the time to show them more TLC than ever.

That's the essence of what we learned from a consultant and two practitioners who are riding out this economy successfully, striking a good balance between the more profitable segments of their business and those that are more recession-sensitive.

Photo: Getty Images

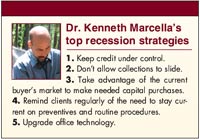

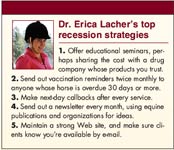

They are Dr. Marsha Heinke, CPA, EA, CVPM, a veterinary practice consultant and accountant in Grafton, Ohio, who also is a licensed equine and small animal veterinarian; Dr. Erica Lacher, who owns a two-doctor, full-service equine practice in Newberry, Fla.; and Dr. Kenneth Marcella, who with his partner Dr. Laura Duvall operates a busy all-equine mobile practice just north of Atlanta.

We asked each of them whether, from their perspective, the recession is having a greater impact on equine practices than other types of veterinary practices. Then we asked for their best survival strategies. Here's what they had to say.

Equine practices feel the pressure

Dr. Heinke says unequivocally that the recession squeezes equine practitioners more than other veterinarians. Why? "Horse ownership costs far surpass those of small animals," she says. "In 2007 and 2008, feed, bedding, and boarding already were increasing at double-digit rates due to regional droughts, energy costs, ethanol production demands on corn supplies, and so forth. All that was happening even before the banking disaster and economic downturn that hit last fall."

As Drs. Lacher and Marcella see it, the recession's impact varies by region. Both say that their clients keep horses more for pleasure than for business purposes and that most will forego some discretionary spending to take care of their horses' medical needs.

Still, "there's no question we've seen some reduction in business," Dr. Marcella says. "The greatest reduction is in breeding, the most purely business side. No one keeps a stallion and a bunch of broodmares just for fun. When horses are selling for less, the economics say you breed less. But we are still busy and profitable."

The principal downside for Dr. Lacher is clients who try to stretch the preventive care intervals she recommends. "For instance, we recommend dentals every 12 months, but some try to stretch that to 18 months," she says.

Make time for increased vigilance

Asked for her top recession strategies, Dr. Heinke says treating staff and clients with a fair amount of tough love is necessary to survive the coming months, when she predicts that bankruptcies among horse owners will ramp up, just as they will for other consumers and businesses. To avoid slip-sliding down that same path, she recommends keeping a close eye on intraoffice procedures and financials—payroll, inventory, supplies, and budgets—and being extra diligent with client service, credit, and collections.

Payroll is the biggest challenge for most equine practices, Dr. Heinke says. She counsels owners and managers to eliminate overtime, watch employee scheduling, and monitor hours worked against those scheduled. "If you're only managing overtime and not looking at hours scheduled vs. hours paid, you'll miss the technician scheduled for 35 hours who managed to clock 39," she says. "Four extra hours here and there can really add up."

As for inventory, Dr. Heinke recommends buying only what you need for 30 days and ordering no more than once weekly. And not that you don't trust your staff, but it's best to "keep employees honest by eliminating temptation," she says. That means keeping all supplies well-secured, because inventory shrinkage and other theft tend to increase during bad economic times. She advises doing physical counts of valuable inventories in trucks and storage areas on a weekly rotational basis.

Keep an eye on the budget

Your operational and capital budgets should stay current, rolled forward each month with actual expenditures monitored against predicted outlays. "Ask your financial advisors plenty of 'why' questions when you don't understand the numbers," Dr. Heinke suggests.

As part of your budget overhaul, she advises revising requisition systems to preapprove purchases before ordering. For example, she says, establish a guideline that states, "If repairs and services are needed, they must first be approved by Dr. X, with a cost estimate," or "All equipment acquisitions and marketing expenditures exceeding $250 must be approved by Dr. X before ordering."

And review regularly the use of vehicles, cell phones, and computers, Dr. Heinke adds.

Love clients but tighten credit and collections

When it comes to clients, Dr. Heinke recommends training team members to deliver a solid message about the value of recommended services, ensuring that clients are crystal-clear about what they need to do. "Too often we leave clients confused and unable to act on a recommendation, and then they may turn to someone less knowledgeable," she says. "Respond immediately to requests for assistance. Act diligently to take the best care of your clients."

Clients who rely on credit and collections, however, require more tough love. Are your policies reasonable in today's climate? If not, revise them. "Don't let credit get out of control," Dr. Heinke says. "Establish cutoff points or lower them, if you haven't already. Speed up collections, preferably collecting at the time of service."

If you have a good client who becomes tardy on payment, call immediately to follow up. "Phone calls should be made as quickly as possible," Dr. Heinke says. "Don't be apologetic; policies should apply to everyone in this tough economy. And cut off credit if you smell a problem."

Plus, if you haven't done so already, start explaining your payment requirements when you schedule appointments—not after you've arrived at the farm to do the work. "Create accurate estimates and ask how the work will be paid for, especially in potentially expensive emergency situations like bad colics, lacerations, and laminitis," Dr. Heinke says.

And finally, keep in mind that if a client owes you money, he or she is less likely to call you and will defer seeking treatment—or use another practitioner. "An account with a zero balance represents your best opportunity for future work," Dr. Heinke says.

Make strategic capital purchases

Dr. Marcella agrees that practices must do a better job with the extending of credit and not allowing collections to slide. "It's easy, during your busiest months, to give clients some slack on payments," he says. "Then before you know it, fall or winter rolls around and they can't pay because of Christmas bills." If banks are tightening credit, why shouldn't the equine veterinary profession? Dr. Marcella says he's done exactly that and has become much more careful about keeping collections current.

Another recommendation: "If you have the money, the down economy is a good time to make capital purchases. It's a buyer's market and you'll find some great deals," he says. Dr. Marcella is preparing to purchase new ultrasound equipment, and at the end of last year he bought a bigger and better truck for less than he paid for his old one four years ago. "These are items we budgeted for and would have bought anyway, but we got great deals," he says.

He also upgraded his office IT equipment, and he and his partner now use GPS in their trucks. "We've found it makes us more efficient in our travel routing, saving fuel and time and in the end saving money," Dr. Marcella says.

He agrees with Dr. Heinke about client service, especially when it comes to scheduling routine care. "If I do a good job explaining to clients why those preventives are important—that ultimately it will save them money by lessening the need to call me for emergencies—I find they're usually willing to schedule the work," he says.

Reach out to your clients

Dr. Lacher's top survival strategies focus primarily on her clients, making sure the best ones get plenty of TLC. Her mantra? "Touch your clients every chance you get." This means finding a variety of ways to reach out to clients—not just waiting until they come to you.

One of the ways Dr. Lacher does this is offering client education seminars regularly, sometimes collaborating with a drug company to share costs. "It allows me to promote my practice, allows the company to promote a product I believe in, and allows my clients to get educated," she says. "I'm careful, though, whom I choose. I want education first and sales second. I've found that clients resent an overt sales pitch but appreciate good-quality education. Educated clients are always better clients."

Dr. Lacher touches clients in another way by sending out vaccination reminders twice monthly and calling those overdue by 30 days or more. "Eastern equine encephalitis is huge in our area, so this call lets us educate them on the dangers of EEE and correct fallacies they hear at the feed store," she says. "We find most clients appreciate the call, and it usually leads to the needed appointment."

After any work is completed, Dr. Lacher touches clients again with next-day callbacks. "Easy checks get a call from the office staff, while more complicated cases get checked on by a technician or doctor," she says.

Dr. Lacher also is a proponent of putting out quarterly newsletters with ideas she's picked up from equine publications and organization Web sites. And finally, she keeps a strong Web presence, making sure her clients know she's available by e-mail for that question they may not want to call about. "I feel this keeps me as their go-to person for information," she says. "We update our Web site every chance we get so clients have a reason to go back to it."

James M. Lewis is a managing editor with Advanstar Communications Veterinary Group.

Veterinary Heroes: Ann E. Hohenhaus, DVM, DACVIM (Oncology, SAIM)

December 1st 2024A trailblazer in small animal internal medicine, Ann E. Hohenhaus, DVM, DACVIM (Oncology, SAIM), has spent decades advancing the profession through clinical expertise, mentorship, and impactful communication.

Read More