Making informed decisions (Sponsored by Intervet/Schering-Plough Animal Health)

Knowing when to upgrade and when to hold on to equipment can save-and make-you money.

As technology continues to develop, equine practices rely heavily on advanced medical equipment—namely that which requires a sizable investment—to provide the advanced level of care clients have come to expect. However, equipment can quickly become obsolete or not cost-effective for a practice to maintain. Often, this happens faster than the practice can recoup the money spent on the initial purchase. But with careful planning and budgeting, you can make an investment that will benefit your clients with great care and your practice with more revenue.

Weigh your options

Your cash flow should support the projected equipment usage. If it doesn't, your profit potential can decrease rapidly. A well-constructed cost/benefit study or break-even analysis can help you project how the purchase will impact your practice. It will take into account the direct and indirect costs of supporting a piece of equipment, the projected use of the equipment, and the professional fees necessary to support the equipment purchase. Also, consider financing the equipment for a shorter period of time than the anticipated usefulness of the purchased equipment.

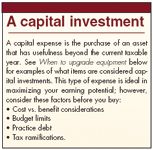

A capital investment

If you don't use a break-even formula, consider all the expenses associated with the use of new or existing equipment. Costs such as technician wages, taxes and insurance, return on investment, administration costs, replacement costs, and facility and vehicle usage must be taken into account when purchasing a piece of equipment or setting an appropriate fee structure.

Look at the books

Most acquisitions can be determined in advance to allow for good budgeting and to avoid impulsive purchasing. A typical budget allows 3% to 5% of its gross revenue for capital expenditures. This figure should include all equipment expenses, including vehicles. If you exceed this figure in one year, it is important to balance it out in the budget within the following year.

A close study of your current debt and balance sheet will help you determine your ability to finance your next purchase. Your total current assets should exceed liabilities by a ratio of 1.5 to 1.0. This is referred to as your liquidity ratio. You can study assets and liabilities easily using your practice's accounting software.

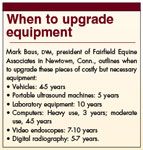

When to upgrade equipment

Appreciate depreciation

Consider the depreciation rates of new equipment purchases. You can elect to accelerate the depreciation in the first year of ownership based on Internal Revenue Service code Section 179. This option allows your practice to claim more of the equipment's value as an expense, resulting in a tax savings for the practice owners. The terms of Section 179 will be changing in the next few years so consult with your accountant to determine the best time to purchase equipment. Bear in mind that when you accelerate the depreciation rate in the first year of purchase, you will be left with lower deductions in the remaining years that you own the equipment.

If you know when to upgrade and when to stick with the equipment you have, you can meet the standard of care you want to provide and keep the revenue flowing.