The new generation of low-value practices

Owners, make sure buyers purchase your practices at a good price.

For years, veterinary practice owners assumed that when they wanted to sell their practices, buyers would be available to purchase them at a good price. Sure, a few practices had problems—they couldn't find buyers, or at least buyers who'd pay what owners thought the practice was worth. But these practices were easy to identify. They were smaller, with older facilities and outdated equipment, and they pulled in relatively little revenue. Fortunately, there weren't many of these troubled hospitals around.

Dr. Karen E. Felsted, CPA, MS, CVPM

Today things have changed. In the past few years, the number of practices with little or no value has been increasing. The valuation committee of the Association of Veterinary Practice Management Consultants and Advisors (AVPMCA), of which I'm a member, has even coined a term to describe these practices: "No-Lo Practice," short for no-value/low-value.

More and more practice owners are surprised when they receive no-value or low-value appraisals. Some of these practices are similar to the historically low-valued hospital: They tend to be small, mismanaged, and unable to keep up with client demand for better service, high-level medicine, and an attractive facility.

Other practices, however, surprise even the experts. On the surface they look great. They're in beautiful facilities with talented doctors and large support staffs, and they're providing good care with all the latest equipment. They offer comparatively high compensation and employee benefits, and in the owners' eyes, cash flow is strong.

The bottom line

So what's gone wrong? Why are these practices not worth what you'd think?

Peeking into profitability

Profitability is the top factor in determining a practice's value. Whether a hospital is housed in a gleaming 20,000-square-foot facility or a falling-down shack, if it's not profitable, it has little value beyond the tangible assets.

Because of this, profitability is one of the most important aspects of managing and, eventually, appraising a hospital. But it's not an easy number to determine. Standard financial or management reports don't show it—not taxable income from a tax return, not net income from a profit-and-loss statement. That doesn't mean those reports have been improperly prepared; it simply means they weren't designed to determine profitability. Most practice owners and managers aren't used to figuring out their own profitability. So, often, the first time they come face to face with the true value of their practice is when their appraiser talks to them about it.

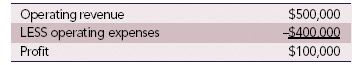

The irony is that the arithmetic isn't hard: To find out a practice's profitability, you simply subtract the operating expenses from the operating revenue. The challenge is digging out some numbers you're probably not used to looking at in determining true operating revenue and expenses.

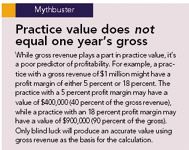

Operating revenue and expenses include items seen in day-to-day operations, such as fees for services and drugs and the cost of medical supplies. These items are listed at fair market value. For ease of comparison with other practices, profitability is stated as a percentage (the profit margin) and is calculated by dividing operating profits by gross revenue.

Some of the items that must be calculated differently to determine your operating profit—not taxable income or net income—include practice owner payments, facility and equipment rent if these items are owned by the practice owner and leased to the practice, services provided by family members to the practice, depreciation, interest on debt, and perks. Let's look at a couple of these in depth.

• Owner compensation. Many owners arbitrarily determine an amount they'll be paid through their payroll system. This amount often has no correlation to the medical, surgical, and management work they actually do; therefore, a tax return or income statement can make the practice look more or less profitable than it really is. IRS regulations also dictate how some aspects of owner payments must be handled, and these regulations vary by entity type—a C corporation vs. a partnership, for example. A practice can appear more or less profitable because of these regulations.

Mythbuster

• Compensation for a family member. The amount paid to a family member working in the practice can be undervalued or not valued at all. Spouses who work as bookkeepers or practice managers are often not paid for their work. If the practice had to hire someone else to do these jobs—say, if you and your spouse left the practice after selling—there would be a cost involved. This cost should be included as an expense when you're calculating true profitability.

Of course, knowing the profitability of your practice is only the first step. The practice also has to be managed in a way that generates profits and keeps expenses down. Many owners of no-value or low-value practices aren't doing this.

Investigating extreme expenses

Initially, appraisers have been surprised by some of the low values we're seeing on very nice practices. But when we look closely, it's apparent that the same traits that make these practices attractive reduce profitability through low revenue, high expenses, or a combination of the two. Let's look at the expenses first.

Inside look

The new low-value practices feature attractive facilities, state-of-the-art equipment, good compensation and benefits, and large support staffs. That's great, but these practices aren't making sure the costs lead to increased revenue. For example, how much space and what kind of building are necessary to practice veterinary medicine? If a practice moves into a brand-new facility and the rent doubles, will there be a sufficient increase in revenue (and profits) to cover the rent increase? There can be, and there needs to be.

The same goes for the team. A doctor's workday may be easier and more personally rewarding with three technicians trailing behind, but does this doctor actually produce more revenue with the additional support staff? If not, staff pay will eat into profitability. Other staff problems include the hiring of minimum-wage team members who can't do the job, too many part-time employees who don't do the job as effectively as full-time team members would, and an overall lack of training and supervision. All of these lead to inefficiency and end up costing money.

And what about all that new equipment? Does the practice use the new ultrasound machine often enough to offset the cost of owning it? Perhaps it would have been better to continue referring these cases. Then there's inventory. Many practices have too much inventory on the shelves, don't adequately price these items, and don't make sure clients are invoiced for drugs, food, or supplies sent home with them.

In addition to monitoring these big expenses, good cost control involves paying attention to the details. Everyone laughs at the classic image of a practice owner who scurries around turning out the lights or fretting over all the paper towels being used, but reasonable frugality is necessary. How much Starbucks coffee really needs to be bought for the staff each week? Is it reasonable to offer health insurance at no cost to employees? Is an outside cleaning service necessary, or could the kennel staff help? Answers to these questions are different for every practice, but most hospitals spend money unnecessarily in certain areas.

Revenue run-through

While expenses are one factor in determining profitability, revenue is the other. Some practice owners don't focus on growing their revenue because they just don't know what to do. Many of them have also been fortunate because the revenue has been there without a lot of conscious effort on their part. If you aren't seeing the 12 percent growth you did a few years ago, you may assume it's because the practice has matured or the community demographics are changing and there's nothing you can do about it. But you have more control than you think.

• Focus on fees. It's not uncommon for me to see a practice that hasn't increased fees in two years or has raised only a few fees by a small percentage. This isn't good. Most expenses rise annually because goods and services cost more. So if the practice isn't raising its fees at least 5 percent per year, profitability suffers even if nothing else changes.

• Examine time on the job. Productivity isn't always as high as it could be because doctors and team members are working fewer hours in an effort to achieve better work-life balance. Also, some practices pride themselves on being "high-touch," spending more than the usual amount of time with clients. If there's not a strong correlation between employees' pay and their work contributions or a link between the fees charged to clients and the time spent with them, then profitability will suffer. I'm not suggesting that practices operate like sweatshops, but, for example, paying an associate $100,000 per year in compensation plus a benefit package when he or she produces $350,000 in revenue will seriously erode profitability. The same will happen if clients get a 45-minute appointment for the price of a 20-minute one.

• Minimize discounts and missed charges. Even a few dollars' worth of products or services given away by well-meaning doctors or staff members can significantly decrease revenue and profitability. Profit can also disappear into the pit of missed charges. Capturing all charges is generally a result of having good systems in place and is essential to efficient operations. Practicing high-quality medicine is always good for revenue production—as long as the practice charges for it.

What new services have you added in the past few years? Do the doctors fully work up their cases and make all necessary recommendations to the client? Are clients following through?

• Cater to clients. It's important to look at client demand—what can be done to improve client service or ramp up your marketing efforts? (For ideas, see "Pump It Up" in the February 2007 issue or look online at vetecon.com.)

Finding the balance

There's no question that it's difficult being a practice owner. Many of you feel caught between your own needs and those of your business, clients, and team members. You may be asking, "How can I have the facility my clients demand without breaking the bank?" or "How can I attract high-quality staff if I don't pay good wages?"

As with most things in life, the solution is a matter of balance. A practice won't be successful if it operates out of a hovel, but expensive light fixtures and custom marble floors won't boost your profits. It's hard to have an efficient practice with just one staff person per doctor on hand, but four times as many staff members doesn't automatically mean four times the profitability.

Seeking solutions

Before you can fix a problem, you must identify and understand it. To that end, the AVPMCA valuation committee has designed the No-Lo Practice Threat Advisory Worksheet, which helps practice owners and managers estimate their practice profitability. The worksheet won't calculate practice value, but it will help you determine profitability, which is the key indicator of value. Ideally, you should review profitability on an annual basis. (For a link to the worksheet, visit vetecon.com .)

Understanding profitability and the factors that help or harm that profitability is critical. Once you know the root cause of the problem, you can move toward the solution.