The year ahead: Things are looking bright for the veterinary profession

While there are a few ongoing and significant concerns among the economic indicators, most signs point to 2018 shaping up well for veterinarians and team members.

Shutterstock.comFor many, 2017 was a great year to be a veterinarian. Here are a few facts to support that statement:

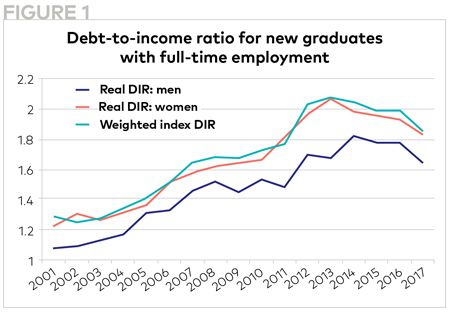

- The debt-to-income ratio (DIR), an indicator of how much society values a veterinarian relative to the cost of educating and producing that veterinarian, fell from roughly 2:1 to 1.84:1.

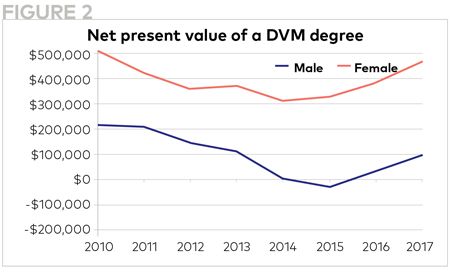

- The net present value (NPV) of the DVM degree, a measure of the lifelong value of a veterinary education, increased for both men and women.

- Finally, veterinary unemployment fell from 1.5 to 0.5 percent, and in aggregate, the supply of veterinarians continued to be less than needed to meet the demands of consumers of veterinary services.

These trends should continue into 2018 and even beyond, according to the macroeconomic indicators we've studied in the AVMA Economics Division.

What's driving the DIR

The DIR fell as a result of strong increases in starting salaries and an increase in the percentage of new graduates who started their careers with zero debt (a 54 percent increase from 2015 to 2017)(see Figure 1). One reason the DIR didn't fall further was that tuition and fees at colleges of veterinary medicine increased significantly-again.

Source: AVMA Economics DivisionThe tight veterinary labor market will likely mean large gains in 2018 starting salaries as well. And if the trend of more graduates leaving school with zero debt continues, we should continue to see a drop in the DIR.

While this is generally good news for the profession, skyrocketing tuition is a cause for concern as it will continue to drive prices for veterinary services higher. This will drive demand for veterinary services lower if veterinary price increases outpace the growth in median household incomes. An additional concern is the growing percentage of new graduates with a DIR in excess of 2:1.

NPV: Good news and bad

Because real (adjusted-for-inflation) starting salaries for new graduates are increasing, the lifelong earnings of veterinarians are also increasing, in turn driving an increase in the NPV of a DVM degree (see Figure 2). However, because of the shift in age distribution in the profession-as well as changes in gender composition, geographic location, percentage of veterinarians who own practices, and distribution across practice types-the mean income for the profession is declining. This trend will likely accelerate in 2018.

Source: AVMA Economics Division

Peering into the basket

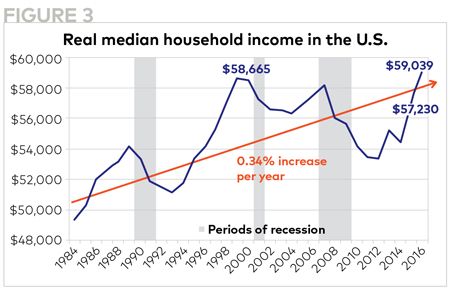

The market for veterinary services, like all services, depends on the “market basket” of expenditures that consumers “select” and the rate at which the prices of goods and services inside that basket change in relation to consumers' incomes. Real median household income measures household income after taking into account weighted price increases for the items in the basket.

Thus, the 3.5 percent increase in real household income between 2015 and 2016 means household incomes grew faster than the rate of inflation by 3.5 percent. In other words, the median household in 2016 had 3.5 percent more income to spend on the market basket of goods and services. As a result, it could opt to increase the amount of goods and services purchased or purchase additional goods and services not currently in the basket (see Figure 3).

Source: AVMA Economics DivisionThis means that at least some pet owners purchased more goods and services from veterinary practices than they had previously. These increased expenditures materialized as additional demand for veterinarians.

Median household income will continue to increase through 2018, setting the stage for an increasing demand for veterinary services. Growth in veterinary incomes should continue through 2018, and both the DIR and NPV should improve.

However, tax reform now working its way through Congress will reduce federal government revenue, leading to further pressure on state and local government budgets, which will further diminish public education funds. The response of public educational institutions will likely be to increase the number of seats filled, increase tuition and fees, or both. Higher tuition and fees will mean greater debt loads for many students, and increasing the number of seats will reduce starting salaries for new graduates. Either action will eventually lead to a higher DIR.

Wage pressures and inflation

The U.S. economy should continue to expand for 12 to 18 months, and the already low U.S. and veterinary unemployment rates will increase wage pressure. This does not mean a recession is 12 to 18 months out; it simply means continued moderate economic growth is expected for this period.

This continued growth is built on business and consumer expectations of legislative and regulatory changes, such as healthcare reform, lower taxes, better trade conditions and less government regulation of business, which is expected to lower business costs, improve profits and increase business investment. The current economic expansion may well become the longest expansionary period in recent U.S. history.

One drag on the economy, however, is housing costs, which are rising quickly in major markets as a result of inadequate supply and increasing demand. The hurricane-related disasters in Florida and Texas, where nearly 20 percent of housing growth takes place, will suck up existing construction resources to repair and replace damaged housing, further tightening the supply of homes and driving housing prices even higher. These rising prices will add to the tight labor market and further bid up the cost of labor-and thus the costs of goods and services.

As a result, veterinary practices will face growing labor and supplies costs, and owners must carefully evaluate the effect of rising “input” costs on profitability-they must ensure that any increases in veterinary pricing don't lead to a net loss in total revenues because of clients' unwillingness to pay the higher prices. As noted in a previous column, keeping price increases within range of inflation will likely not impact client purchases. If your practice has not experienced revenue growth over the last 24 months, you may want to consider focusing on a high-volume business model.

In conclusion: While the big-picture economic trends are, as always, a mixed bag, more signs point to a good year to year-and-a-half ahead than those that point negative. Wise veterinarians will make decisions accordingly, so that whether times are good or bad, they will be in the best position possible for financial success.

Michael Dicks, PhD, is director of the AVMA's Veterinary Economics division.