An ailing veterinary profession: Six diagnostic indicators

The poor financial health of veterinarians is more evidence that the profession must act on permanent and lasting change to save itself from itself.

Next >

Just 22 percent of veterinarians believe the veterinary profession is in a healthy state, according to a new study from Veterinary Pet Insurance and Veterinary Economics magazine. This research, summarized on the following pages, reflects the dollars and cents problems plaguing veterinarians—from young associates mired in personal debt to the vulnerable owners of solo veterinary practices. The diagnosis? It’s bleak. These financial ills may even be a cancer that undoes the profession. Is it too late or is there a chance for a turnaround? Read on to find out more.

RESULT 1: ASSOCIATES ARE STRUGGLING FINANCIALLY

Half of all associates—and 81 percent of Gen Y associates—are paying down student debt. Nearly a third of associates rate their financial condition as poor; 30 percent rate it as moderate.

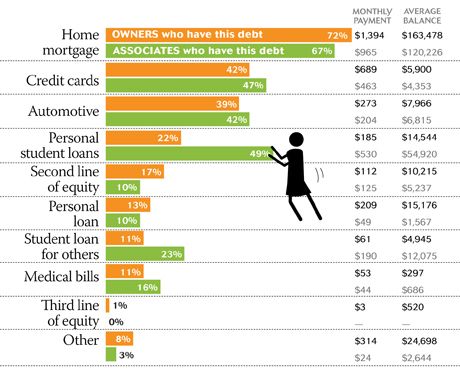

Veterinarians’ personal debt

Veterinary associates are paying $530 in personal student loans every month, compared to owners, who are paying only $185.

All charts adapted from the VPI-Veterinary Economics Financial Health Study, 2014

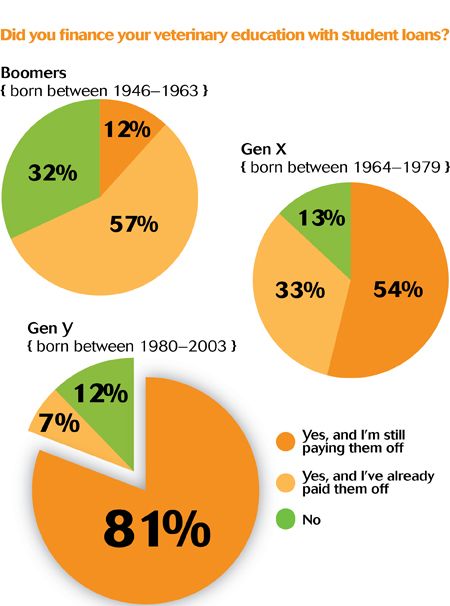

Student debt status

More than and 50 percent of Gen X and 80 percent of Gen Y veterinarians still have student loans.

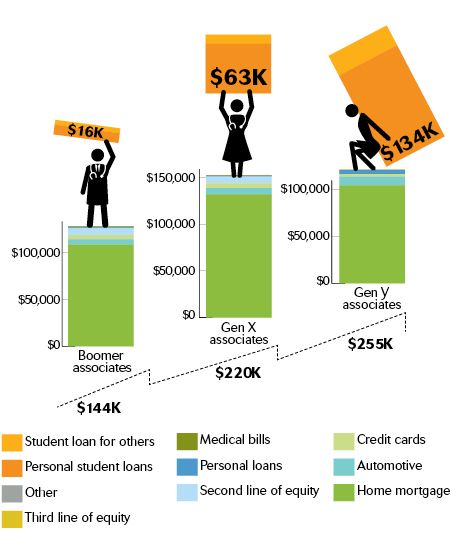

The burden of student debt

For younger associates, student debt—for themselves and others in the household—represent the biggest debt burden.

RESULT 2: PRACTICE OWNERSHIP IS INCREASINGLY ELUSIVE

Practice ownership is not realistic for many associates. While many dream of owning their own veterinary practice someday, a majority consider the prospect unrealistic—due primarily to their high student debt load.

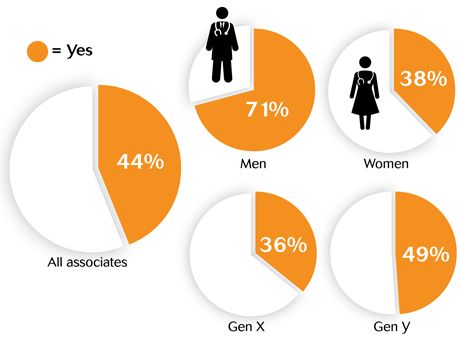

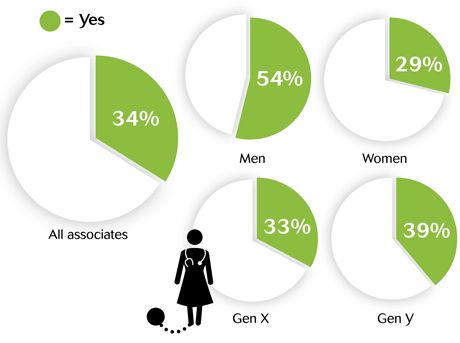

Are you interested in practice ownership?

Men show most interest, with Gen Y veterinarians being more interested than Gen Xers.

Do you have the financial means to run your own practice?

In the current economy, a combination of student loans and the difficulty of trying to make ends meet makes practice ownership a challenge among newer graduates.

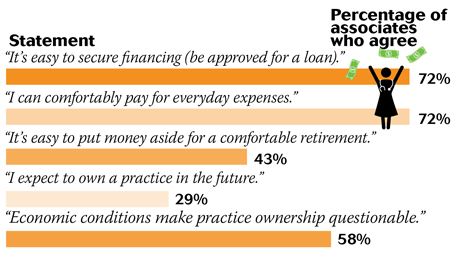

Making ends meet

The majority of associates are making ends meet, but less than half can put money aside for retirement and most are not optimistic about owning a practice.

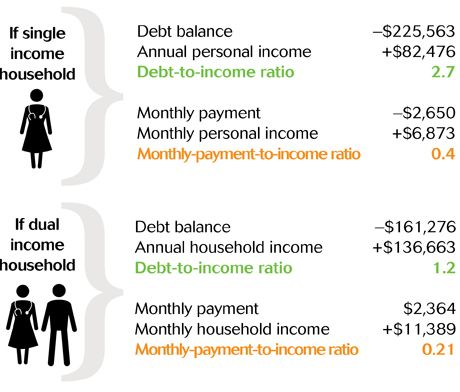

SIDE NOTE: DUAL VS. SINGLE INCOME

It may not be fair, but the data shows that sharing the burden of finances makes a real difference in income. It also lessens the burden of debt repayment.

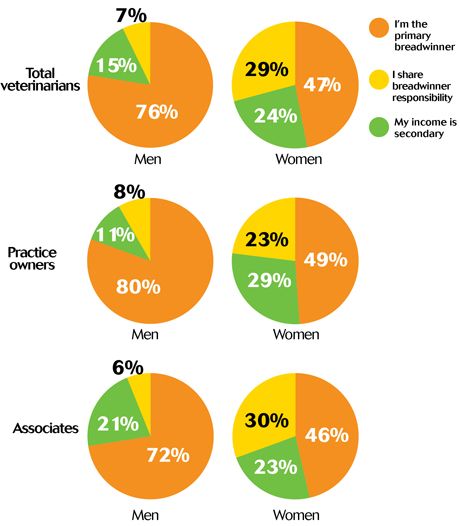

Who’s the breadwinner?

Nearly all male veterinarians consider themselves the primary or shared breadwinner of the household, while more than two-thirds of women do as well.

Single income, more debt

Overall, veterinary associates in a single income household on average have an especially burdensome debt load, with nearly 40 percent of their monthly income going to pay down debt.

RESULT 3: PRACTICES ARE STRUGGLING FINANCIALLY

Veterinary practices aren’t doing too great either. While a third of owners say their practice is doing well, an equal number say it’s doing poorly. Fortunately, nearly half of practices saw a positive bump in patient traffic and revenues in 2012 compared with 2011.

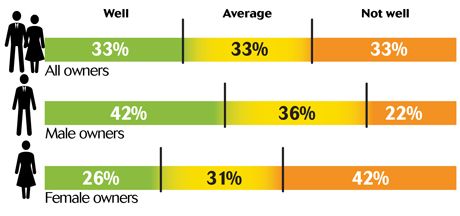

How is your practice doing financially?

While total owners are equally split in their perception of their practices’ financial performance, men perceive that their businesses are doing better than women do.

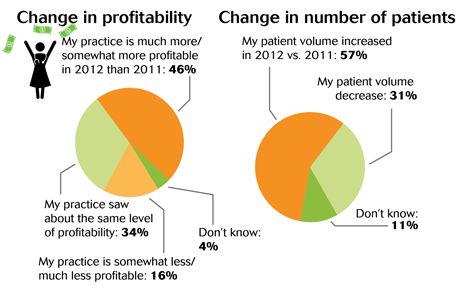

A ray of hope: Visits and income bouncing back?

More than half of practice owners say patient volume increased in 2012 vs. 2011, and nearly half say their profits were up.

RESULT 4: SMALLER PRACTICES ARE STRUGGLING THE MOST

The most vulnerable practices are the smaller, more typical one- and two-doctor practices. They are performing much more poorly than larger practices.

Income by practice type

Veterinarians at larger practices report higher personal and household income than those at smaller practices.*

*Small practices were considered those with two or fewer full-time equivalent veterinarians; larger practices those with three or more.

Prospects of financial health

Owners of larger veterinary practices are far more positive about the financial health of the practice than owners of smaller practices.*

*Small practices were considered those with two or fewer full-time equivalent veterinarians; larger practices those with three or more.

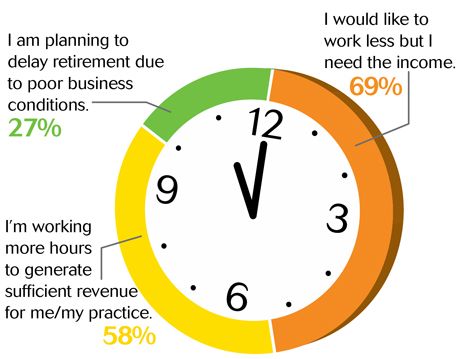

RESULT 5: VETERINARY PRACTICE OWNERS ARE WORKING MORE (AND LONGER) THAN THEY WANT TO

One of the more poignant findings of this study is that a majority of owners are working more hours than they would like because they personally need the money or the practice needs the revenue. And more than a fourth of all owners are planning to delay retirement due to the poor financial condition of the practice. Traditionally, the value of the practice has been the veterinarian’s nest egg. Not so much anymore.

RESULT 6: VETERINARIANS ARE OVERWHELMED BY FINANCIAL MATTERS

A very large number of veterinarians are not at all confident in their ability to manage finances.

Study methodology

The primary objective of this study was to obtain a broader picture of the financial health of veterinarians, including more detailed information about household incomes and debt loads among companion animal practitioners. To that end, Veterinary Pet Insurance and Veterinary Economics magazine conducted a nationally representative survey of veterinarians to understand their personal financial health and the current financial state of their practices. Here are the details:

> Total sample included 1,193 veterinary practice owners and associates.

> Qualifying participants’ practices saw 75 percent or more companion animals (including birds and exotics).

> Online survey was sent out to readers of Veterinary Economics.

> Average statistical margin of error is ± 2.8% (all respondents) at 95 percent confidence level; ± 5.4% for owners; ± 3.6% for associates.

Episode 29: Using storytelling to retain and attract new veterinary clients

November 19th 2020On this episode of The Vet Blast Podcast, Adam Christman, DVM, MBA, is joined by Australian veterinarian, Phil Tucak, BSc, BVMS, who offers insight on the power of storytelling in marketing your veterinary practice.

Listen