Does new data show veterinary prices dropping?

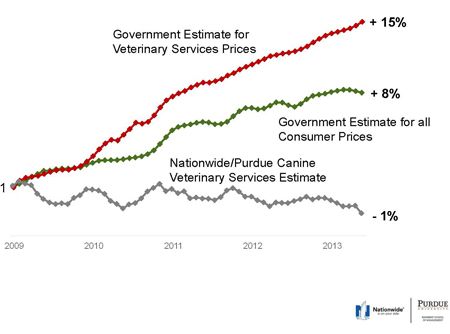

Uncle Sam says post-recession prices are up 15 percent, but new research from VPI-Nationwide and Purdue University hints at stagnation.

Bucking the U.S. government's assertion that prices for products and services at veterinary hospitals rose 15 percent from 2009 to 2013, pet insurance provider VPI-Nationwide and an economist from Purdue University's Krannert School of Management have concluded that charges for veterinary services actually fell 1 percent in that four-year period.

In creating this inaugural Nationwide-Purdue Veterinary Price Index, researchers sorted more than 5.3 million pet-health insurance claims for dogs into 1,208 distinct treatments. The researchers chose a representative “basket” of more than 100 common treatments in the four-year period to use as their basis for comparison. In contrast, Purdue economist Kevin Mumford, PhD, says the the U.S. government's research involved Bureau of Labor Statistics staffers phoning a few hundred hospitals to ask about prices on their two most common services.

“We think the government let veterinarians choose what to report, and they chose the easiest service to recall,” Mumford suggests, elaborating on the reasons for the discrepancy. “Maybe it was the receptionist answering the question. For whatever reason, those services veterinarians reported were overemphasized in the government's results, not accurately reflecting what veterinarians actually do.”

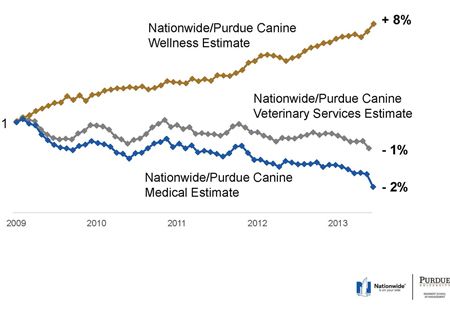

While the Nationwide-Purdue Veterinary Price Index showed a slight overall decline in the prices veterinarians were charging, not all claims reflected this downward trend. Of the 5.3 million claims, roughly 75 percent were “medical” treatments (otitis externa, atopic dermatitis, gastritis and so on) and 25 percent were “well-pet” treatments (physical exams, vaccinations and heartworm tests, for example). Prices veterinarians charged for medical treatments fell 2 percent between 2009 and 2013; prices they charged for well-pet treatment increased by 8 percent.

The big question, of course, is what does this all mean? For the answer to that, we turned to three veterinary insiders who attended VPI-Nationwide's presentation of its findings to get their take.

Dr. Michael DicksMichael Dicks, PhD, director of the AVMA's Veterinary Economics Division, says he's glad VPI-Nationwide has committed to the price index effort. “Their data set is rich, and we can find out a lot from it,” he says. “But I have a few reservations about the usefulness of the data.”

First, he says, the period is heavily affected by the aftermath of the recession. Second, the sample consists only of insured pet owners, “and we don't know whether their purchasing patterns are the same” as non-insured owners, he says.

Third, Dicks says, analysts know that the number of untreated pets is rising, but they can't say whether that's happening because of lower consumer income or higher veterinary prices. The AVMA is addressing that question in 2015 by fielding consumer surveys. “We want to know why they didn't go to the veterinarian,” he says. “We'll also ask what veterinarian they go to and follow up with those doctors.”

Dicks' hypothesis is that wellness care will prove to be very income-elastic-“that is, if you raise prices, you'll lose clients.”

Dr. Karen FelstedKaren Felsted, DVM, CPA, MS, DVM, CVPM, a highly sought-after speaker, writer and consultant on veterinary practice finance and practice management, says the index is one of the most interesting studies she's seen in a while, but she's not sure prices have gone down that significantly.

“From my viewpoint, it's not really a price index, it's a cost-of-treatment index,” she says. “Take otitis externa, for example. If you're a pet owner, maybe it cost you $200 to get your dog's ear infection treated. That treatment may have included a few different products or services. But if the charge for that treatment drops to $175, that doesn't mean prices went down. It could mean the number of services for that treatment went down. Or it could mean the veterinarian did all the services and then discounted them.”

Felsted says the study raises a scary prospect: “If Nationwide digs into the data and finds practices used to perform five services for a particular treatment, but now they do four, what happened? Were those practices performing more than they needed back then, or is medicine suffering because clients don't want to pay for better treatment?

“I don't think there's anything actionable yet for veterinary practice owners,” she continues. “But it helps because we need a better understanding of price in pet owner decision-making.”

Fritz WoodFritz Wood, CPA, CFP, a speaker, writer and consultant who specializes in veterinary practice finance and veterinarians' personal finances, says he was surprised at the data. He expected that any analysis of veterinary prices over a recent period would show an increase. “But I guess I have seen lots of veterinarians who've been afraid to increase fees or increased them less frequently,” he says.

He also notes that the people who buy pet insurance aren't representative of the general pet-owning public. In fact, they're the very best veterinary clients, he says. He has observed that in a typical veterinary clinic, 75 percent of revenue comes from wellness services, and 25 percent comes from medical treatment-exactly opposite of what the Nationwide-Purdue index found.

“If we sit back and think about it, this is all based on claims,” he says. “Who's filing claims? Supposedly someone who has something other than a well pet. So [this data] is going to skew towards ‘medical' treatments rather than ‘wellness.'”

Wood says that for many years in veterinary medicine, “wellness as a category has subsidized sick pets. Veterinarians have trouble with the high dollar amounts [for some sick pets]. It's just easier for doctors to sell more at a low price than the other way around.”

FDA approves oral drug for broad canine protection against parasites

October 7th 2024Elanco's lotilaner, moxidectin, praziquantel, and pyrantel chewable tablets (Credelio Quattro) provide a single monthly dose for protection against fleas, ticks, heartworms, roundworms, hookworms, and 3 species of tapeworm.

Read More

dvm360 announces winners of the Veterinary Heroes program

Published: September 6th 2024 | Updated: November 5th 2024This year’s event is supported by corporate sponsor Schwarzman Animal Medical Center and category sponsors Blue Buffalo Natural, MedVet, Banfield Pet Hospital, Thrive Pet Healthcare and PRN Pharmacal.

Read More