Fight your fear of pet insurance paperwork

Overwhelmed by the thought of recommending pet insurance because of the administrative work involved? Don't fret. These tips can simplify the process and make pet insurance pay for your veterinary practice.

There are a lot of pros to pet insurance: It helps remove the financial constraints that factor into many pet owners' stop-treatment thresholds. It can improve wellness-care compliance and add revenue to a practice's bottom line. But there's a con that might keep some practices from recommending this product to their clients: the image of mountains of administrative work for team members. Who wants to deal with that?

But the truth about pet insurance is this: It doesn't take tons of extra effort to make it pay for your practice and patients. Here's how to make it easier on everyone involved.

Put paperwork dread to rest

"Many practices are fearful of pet health insurance, and understandably so. Paperwork, paperwork and more paperwork, right?" says Jennifer Volmer, a veterinary technician at Eads Animal Hospital in Eads, Tenn. "Actually, it's the opposite." In fact, when it comes to pet insurance, your practice is a third party that can be minimally involved in the process beyond documentation of services rendered. Only if you take the extra customer care step of filing clients' claims does pet insurance really involve increased work—and even then, it's not much.

Volmer and her teammates offer to fax claim forms and invoices for clients, "and that only takes about two minutes," she says. Courtney Grissell, a receptionist at Spring Creek Animal Hospital in San Antonio, Texas, spends no more than 15 to 20 minutes a week filing claims. On the forms, she checks the preventive care box or the medical/accident box, attaches a copy of the patient's invoice, and faxes both pages or mails the claim.

Even at a practice with higher numbers of insured patients, the workload is manageable, says Christine Akers, pet insurance coordinator at Bowman Animal Hospital in Raleigh, N.C., which has roughly 300 insured clients. "I have one day a week that I set aside specifically for filing claims," Akers says. "A smaller clinic may only need a couple hours a week."

Pick an insurance expert

Not every practice that recommends pet insurance has designated an insurance coordinator, but appointing one team member (that's right, not a doctor) to this role can benefit everyone involved. Volmer is that person at her practice. She answers insurance questions for clients, acts as a liaison between the insurer and pet owners, and keeps the staff informed and motivated to encourage clients to make the choice to have their pets covered by insurance.

Train team members

One expert, everyone informed: That's the formula successful practices follow when it comes to pet insurance. While it's helpful to direct clients with questions to one specific team member, every employee should be well trained regarding pet insurance. "Staff members should be able to easily discuss pet insurance with current [and] new clients," says Sarah Yonkey, a nurse at Dogs Only Medical Center and Ohio Veterinary Dental Service in Gahanna, Ohio. "We review insurance plans and discuss changes at staff meetings, so everyone is on the same page."

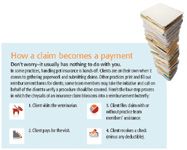

How a claim becomes a payment (ICONS/TOM NULENS/GETTY IMAGES)

To ensure knowledge, Volmer and her teammates took an online training class. Akers' practice holds annual lunch-and-learns, and she created a training handout to help teammates become more familiar with the practice's pet insurance recommendations. Bowman Animal Hospital, where Akers works, has another way to get employees up to speed on pet insurance: It provides the product as part of its employee benefits package. Having their own pets covered by the same insurance the practice recommends gives team members the experience of actually using the coverage and helps them promote it with confidence, Akers says.

Educate clients

Grissell says the biggest challenge for receptionists is getting clients to sign up for pet insurance. "Most clients don't understand how it works or how it may benefit them and their pet," she says. And that's where expert employee knowledge comes into play, Volmer says.

"The largest part of encouraging clients to get insurance has been communicating what a great thing it can be to our clients," Volmer says. Improving communication on the subject is a topic at all staff meetings, she says. Brochures are readily available, and clients can use a computer kiosk to receive an online quote right in the hospital. Volmer and her team are always asking, "Does your pet have pet health insurance?" to remind clients.

Your practice's veterinarians should be part of the process, too. "To get clients on board I recommend pet insurance to every client," says Dr. Susan Prescott, owner of Dogs Only Medical Center. "At the end of each visit, I ask if they have an insurance form that needs to be signed. Even if they don't, it keeps them aware of the benefit."

And indeed, the benefits can be great. "An annual exam with vaccinations, wellness blood work, and heartworm and flea prevention is close to yearly premium costs," Volmer says. "If a pet is sick or has an accident, clients can breathe easier knowing they're covered. The question changes from 'How much will this cost?' to 'What's the best treatment plan for my pet?'"

Really, isn't that what counts? Sure, recommending pet insurance can positively affect your practice's bottom line. (Akers cites a VPI study that found every 25 new policyholders can present a practice with additional revenue of $110,000—double the revenue from 25 high-value noninsured clients.) "I do think pet insurance helps the bottom line," Dr. Prescott says, "but most importantly, it helps the pets."

Erika Rasmusson Janes is a freelance writer and editor in New York City.