How big of a deal are student loans?

The hardest part of consulting clients on student loans is that giving the best option requires knowing details of both their balance sheet and personality

Nuthawut/stock.adobe.com

We’ve met with veterinarians all over the United States who worry about their student loans. The turmoil for some is such that it literally keeps them up at night. On the other end of the spectrum are the veterinarians who simply choose to pay the minimums required and fully accept whatever fate awaits them in the future since the alternative would be to postpone nearly all semblance of fun in their financial lives to make a “dent” in the loans. The message of this article boils down to one thing: student loans are rarely going to be the financial cancer that they often are believed to be and when a veterinarian approaches them properly they can appreciate what their loans have done for them and not see them as an undue burden to their financial lives.

Side Note: There have been lawsuits filed against schools for predatory lending. I don’t have a lot of space to go into detail about this subject but feel free to search on Google whether your school has been involved in a lawsuit so you can apply for student loan forgiveness if that school was found to have engaged in predatory lending. You may be able to get some level of forgiveness on your loan if you apply through the proper channels.

During COVID there was a freeze on the interest that could accrue on student loans. That freeze lasted all the way until October of 2023. Nearly three years American veterinarians were able to sit on their student loans and delay payments. Some took advantage of this in different ways. Those who are not able to see past their loans and are deeply emotionally affected by them took advantage with the delay by paying as much as they could to reduce the principle knowing that at some point in the future the interest would start again. Others focused on building their assets by saving the money that otherwise would’ve gone to payments. Yet others did nothing at all and spent the money that would’ve gone to it anyway. It should be noted that each of these paths would’ve provided some upside to the individual thus we shouldn’t judge our past selves nor other people based on their decisions.

Which avenue was the best choice? It all depends on your personal situation. The hardest part of consulting clients on student loans is the only affective way to give them the appropriate option is to know all the intricate details of their balance sheet AND their personality. What do they have in their savings? What’s the balance of their student loans? Are they planning to buy a home? Get married? Have children? What is their income? What is their spouse’s income? Where do they live? What is their tax situation? Do they worry about their loans? Is there a chance that putting extra would benefit them in some way emotionally in the short term? Are there other emotions or family dynamics playing into the internal chaos they may feel about their loans? Even though it would be impossible for me to give direction to everyone reading this article, what I can tell you is that student loans rarely are as big of a deal as they seem and should be approached strategically.

I don’t want to downplay the emotional aspects of this. Emotions shouldn’t be ignored when it comes to making financial decisions. If there is anything psychology can teach us, it’s that the more you ignore emotions the more those emotions play into our subconscious decision making and affect other aspects of our lives. This doesn’t mean we should make decisions based solely on emotions – merely, that taking them into account can teach us about ourselves and about the solutions that can enhance our lives as individuals. Emotions provide windows that can allow us to learn about ourselves in ways that can open up opportunities and possibilities completely outside of our purview.

Let’s run through some numbers. Firstly, so that we can utilize math to see objectively that the impact of student loans can be mitigated quite easily. Secondly, in hopes to diminish the emotional havoc that some may be experiencing. This is going to be great news for a lot of veterinarians!

When I speak to someone who is just out of vet school, typically, their income is around $100,000 per year. Obviously, some make less (Like around $65,000) and some make more (like around $200,000). I am going to use an example of someone making $100,000 so that you can do quick math by being able to plug your income into this model as a percentage of $100,000 (being 100%). In other words, if your income is $150,000 a year then you can just take all the numbers below and multiply them by 1.5 since your income is 50% higher than $100,000.

Hypothetical example for illustrative and educational purpsoes only.

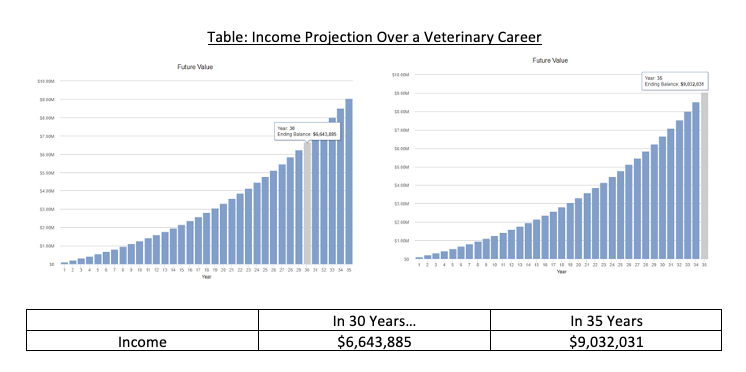

When I project out what someone making $100,000 the day they get out of vet school, assuming they work for 30 years before they retire, with a growth rate of 5% annually, the total amount of money they would end up making during that time period would be $6,643,885! Now, when I look at their loan amount today of $250,000, it appears insanely small compared to the amount of income they will make during their career. If they end up working 35 years that number goes up to $9,032,031!

I don’t want to downplay the effect on the student loans to their income. Some of our financial models show that a $250,000 student loan can reduce the income they will enjoy from that $9M to nearly $8M instead. But this shows that even though the impact is high, it’s not going to complete bankrupt a veterinarian making $100,000 who has a student loan balance of $250,000.

Often, we will meet with clients where their student loan balance is four to five times their annual income. In other words, for every $1 that they make per year they hold $4 to $5 of student loan balance. This would mean someone making $100,000 can sometimes have a student loan balance of $400,000 or $500,000. In those instances, the income-based repayment programs that are available will provide relief in their cash flow temporarily, but unless their income grows dramatically they will need to take advantage of some sort of student loan forgiveness in the future.

There is still a chance though that their incomes will outpace the student loan payments and they may be able to pay them off quite easily. When we review historical growth rates of incomes for clients over 30 to 40 years, we will sometimes find that their income grew at astounding numbers. Annual growth rates have been calculated to be 8% in some instances. This would mean that if someone is making $100,000 out of school the total income they would’ve made over 35 years would be over $16,500,000!

Practice ownership is also another way that veterinarians have been able to increase their income to outpace their student loans. I, myself, have personally seen many veterinarians make huge progress paying off their student loans by becoming successful practice owners just within the last decade.

All this to say that even though student loans may have scary balances they were essential to getting veterinarians through to the other side of being able to serve their communities in the best possible way for them: being veterinarians. Student loans should be approached from a financial position of emotional strength and hope, and not be an added stress to the already stressful lives that we veterinarians live.

Of course, we are always here to discuss your individual needs should you want to explore strategies for your own financial success.

Material discussed is meant for general informational purposes only and is not to be construed as a recommendation or advice. Please note that individual situations can vary therefore, the information should be relied upon only when coordinated with individual professional advice.

Securities products and advisory services offered through Park Avenue Securities LLC (PAS), member FINRA, SIPC. OSJ: 4200 West Cypress Street, Suite 700, Tampa, FL 33607, 813-289-3632. PAS is a wholly owned subsidiary of The Guardian Life Insurance Company of America (Guardian), New York, NY. The individuals associated with Florida Veterinary Advisors do not maintain specialized licenses or qualifications for the financial services provided to veterinary professionals. Florida Veterinary Advisors is not registered in any state or with the U.S. Securities and Exchange Commission as a Registered Investment Advisor. Florida Veterinary Advisors is not an affiliate or subsidiary of PAS or Guardian. 2024-170220 Exp 3/26