Inside the Consumer Psyche

National Report - Money isn't everything. Especially when it comes to consumer attitudes about rising veterinary fees.

NATIONAL REPORT — Money isn't everything. Especially when it comes to consumer attitudes about rising veterinary fees.

Compassionate care and the human-animal bond trump pet-owner worries about the escalating costs of veterinary care, at least for now, according to consumer research from the American Veterinary Medical Association.

Yet, the balance between economics and consumer adoration is of such concern that AVMA is moving forward with its next phase of a long-term consumer research agenda, reports AVMA Director of Marketing James Flanigan.

"You can't do one survey and expect to know everything about what the public knows, feels or understands," Flanigan tells DVM Newsmagazine. "This has to be an ongoing effort."

Landmark unpublished research from AVMA last year performed a kind of consumer stress test over elevated fees. A recheck is scheduled this year, for good reason.

In 2007, the cost of veterinary care is expected to swell from $9.2 billion to $9.8 billion, a $600-million climb, according to fresh estimates from the American Pet Products Manufacturers Association (APPMA), one of a slew of economic indicators showcasing growth in this market.

Slated to chart malpractice threats or consumer attitudes about animal rights, the bulked-up AVMA research project will pick up where last year's results left off.

With more than 3,000 households chiming in, AVMA's 2006 survey depicts a public "not as sensitive to price as we may have perceived. While they believe, by and large, veterinary care is expensive, in the end it does not seem to be affecting their willingness to pay for quality care." A similar picture emerges from last year's price sensitivity survey by BN Research. (DVM Newsmagazine, January 2007.)

Veterinarians and clients are looking at fees from two different vantages, AVMA research suggests.

"Clients are saying give us more. Veterinarians perceive they are saying charge us less," says Flanigan.

The average annual cost of veterinary care, APPMA estimates, is still a relative bargain — $219 for dogs and $175 for cats. Average annual surgery fees are likely to cost $453 for dogs and $363 for cats. The total yearly cost of owning a dog is about $1,453, APPMA's survey says. Officials are quick to point out that sick-animal care presents a completely different scenario and could easily cost thousands of dollars.

The key point: The owner's bond with his or her animal and veterinarian drives the perceived value of veterinary care. In turn, that bond reduces the perceived cost of care.

The human-animal bond is driving demand for veterinary services and pet ownership. Both are on the upswing.

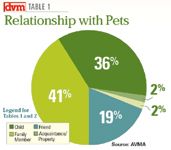

Table 1: Relationship with Pets

About 77 percent of pet owners responding to AVMA's survey classify their pet as their "child" or "family member." In contrast, just 2 percent described their pets as property (Table 1).

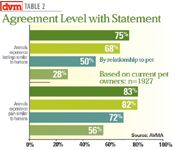

Animals experience feelings and pain similar to humans, according to a majority of respondents (Table 2).

Table 2: Agreement Level with Statement

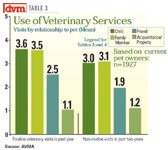

The number of visits to a veterinary office each year is influenced by the relationships people have with their pets. For example, if an owner called his or her pet a child, the number of routine veterinary visits was a mean of 3.6 in the past year. For pet owners who called their pets friends, the mean dropped to 2.5 visits per year.

The same trend held true for non-routine visits in the past two years (Table 3).

Table 3: Use of Veterinary Services

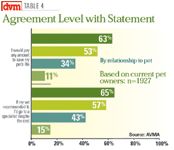

Sixty-three percent of clients who believe their pet is like a child would pay any amount of money to save their pet's life (Table 4).

Table 4: Agreement Level with Statement

"If my vet recommended it, I'd go to a specialist despite cost," according to a majority of survey respondents.

Table 5: Perceived Veterinary Treatment of Pet

Clients not as bonded to pets are less likely to take such heroic measures, the survey reports. And humane euthanasia remains an important reality. Veterinarians responding to a 2006 DVM Newsmagazine survey cite increasing stop-treatment points for veterinary care average $1,451.

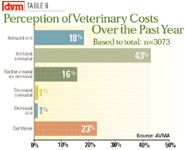

Table 6: Perception of Veterinary Costs Over the Past Year

Yet, a key indicator of value has to do with the perceived level of treatment delivered, the AVMA survey reports. Veterinary medicine scored very high in this category. Sixty-seven percent of pet-owner respondents said their pet's care was comparable to their care from physicians. Another 26 percent said it was better than their physician's care.

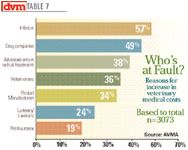

Table 7: Who is at Fault?

On the cost side of the ledger, pet owners (61 percent) noticed increases in fees over the past year. Only 23 percent were unaware of price changes. Yet pet owners didn't blame their veterinarians: The scapegoats were inflation, drug companies and advancing costs of medical treatments.

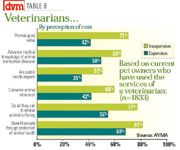

Table 8: Veterinarians...

Whether a pet owner viewed veterinary care as expensive or inexpensive, the majority of respondents say veterinarians "do all they can to relieve animal suffering" and "benefit society through protection of animal health."

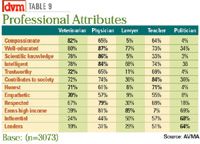

Veterinarians received the highest pet-owner marks for "compassion" and lowest for "leadership." Only 39 percent believe veterinarians "earn a high income," yet 72 percent call DVMs "trustworthy."

By comparison, politicians and lawyers scored as the least compassionate and as contributing the least to society (Table 9).

Table 9: Professional Attributes

Dicing up the market

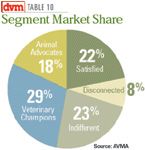

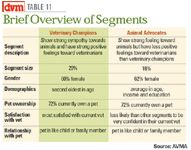

AVMA's survey attempted to segment pet owners by attributes in order to give them a view of market share. The classifications include: veterinary champions, animal advocates, satisfied, disconnected, indifferent.

The idea is to provide data about pet owners most likely to seek veterinary care.

Veterinary champions show strong sympathy toward animals, and have strong positive feelings about veterinarians. They represent 29 percent of the market and are 60 percent female.

Table 10: Segment Market Share

"What we are trying to do at AVMA is be the eyes and ears of the veterinary profession and to build a base of knowledge so the profession's leaders can make informed decisions."

Table 11: Brief Overview of Segments

With the next round of pet-owner research scheduled this summer, Flanigan adds, "It will be fun to look through the banners to see what the data are really telling us. I hope it is good news."

Drivers for rising veterinary costs

- Veterinarians' demand for more income in fewer hours.

- Veterinary organizations believe there is a shortage of doctors overall, although there is debate about the distribution of veterinarians and some areas may be overpopulated.

- Salaries for associates are climbing.

- Fewer business units exist, largely because of consolidation of smaller/solo practices (fueling less competition, therefore higher prices).

Source: American Veterinary Medical Association

Timeline:

2002: Dr. Joe Howell, former AVMA president, questions whether rising veterinary costs are affecting public perception of veterinarians.

2003: Consumer Reports seizes on rising costs of veterinary care with a report titled "Pets and Vets – Veterinary Care without the Bite." Wounded by the report, AVMA rebuttal targets rising consumer demand. Work to quantify and benchmark consumer trends is launched subsequently by AVMA's Council on Communications.

2004: Headed by Dr. Jack O. Walther, AVMA's Communications Task Force wants consumers on speed dial through "ongoing initiatives to research attitudes, perceptions and behaviors."

2006: AVMA completes its first pet-owner attitude study, audited by Inform Research. The project dovetails with a separate BN Research study commissioned with Banfield, The Pet Hospital and industry partners to investigate pet-owner attitudes.

June 2007: Expanded consumer research is on the drawing boards; a separate pet demographics survey will hit the market later in 2007.