Synchrony buys pet insurance company

Under parent company Synscrhony, CareCredit, which helps veterinary clients pay for care, has acquired a long-term solutionpet insurance company Pets Bestto include for a comprehensive financial solution for pet owners.

Image courtesy of Synchrony

This cat approves of mergers like this, which bring together companies with natural adjacencies to produce more comprehensive products that could help veterinary practices get paid for their services. (We think it does. Cats don't talk, so ... ) (Image: Synchrony)In a move that brings together loan capabilities with long-term pet health insurance coverage in one company, consumer financial services company Synchrony-owner of CareCredit-has acquired the pet health insurance company Pets Best.

“Pets Best provides CareCredit with an immediate entry point into the rapidly growing pet insurance market,” reads the press release. “This acquisition will allow CareCredit to offer a comprehensive suite of payment options for veterinarians and pet owners to help pets get access to the care they need.”

Wait, credit cards and pet insurance what now?

Has it been too long since you scoped out the options that veterinary clients can use to help pay for your hospital's care? The dvm360 team just updated a comparison chart on third-payment plan providers for veterinary practices. Click here to see it.

We also updated our pet-insurance comparison chart last year. Click here to see it.

What are the benefits for the companies and the veterinarians who may be talking to pet owners about payment options like CareCredit and pet insurance options like Pets Best?

“CareCredit will leverage Pets Best's leading technology and strong experience in the growing pet health insurance market,” reads the release. “Pets Best will have access to CareCredit's deep healthcare market penetration and access to veterinary practices and veterinary industry associations. In the future, CareCredit will offer consumers access to comprehensive care for their pets by combining financing and insurance options, providing a seamless customer experience.”

From the pet insurance angle, Pets Best president Chris Middleton says the merger is a chance to raise awareness for pet insurance, a service to the company's ultimate mission of saving animals.

“Our primary goal is making sure economic euthanasia does not occur,” Middleton says. “Being able to partner with someone with the capabilities and reach of CareCredit will make us a total solution that includes insurance and credit.”

CareCredit's reach in veterinary practices is a perfect opportunity, says CareCredit EVP and CEO Beto Casellas.

“Forty percent of our CareCredit customer base has had a transaction at a veterinary office,” says Casellas. “We see quite a bit of runway left in terms of number of pets insured, with very low single-digit penetration [for pet insurance with U.S. pet owners].

“One of the biggest inhibitors to growth of pet insurance is [lack of] awareness of pet insurance and the benefit it brings,” Middleton says. “[It's a benefit to] be able to partner with the CareCredit folks, who have a large customer base and who understand the [veterinary] market.”

Having just announced the sale March 6, Casella says it's too early to talk about changes to the look and feel of CareCredit or Pets Best materials for pet owners and veterinary practices or any possible discounts for users of either of the two products.

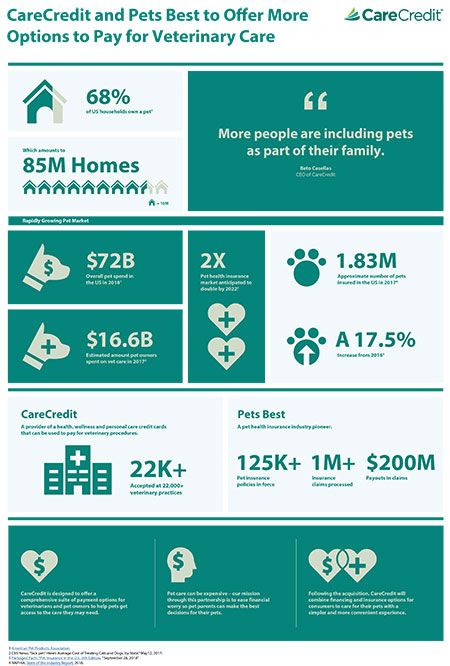

If you want to see some hand-picked statistics and thoughts that the companies developed into an infographic, click here or on the image below to pop up a PDF.