- Veterinary Economics (November)

Veterinary industry trends to watch in 2024 (Part 2)

More emerging trends to keep on your radar in the next year and beyond

In the

Artificial intelligence utilization and regulation

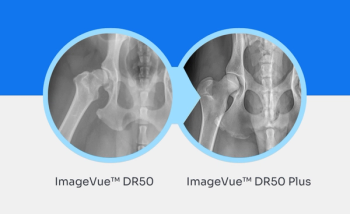

While the concept of artificial intelligence (AI) in animal health is not entirely novel, the veterinary industry is currently witnessing an upsurge in interest and applications. This trend is evident with startups and established companies alike, all dedicated to introducing AI-driven tools that span various facets of veterinary practice: PIMS with integrated AI capabilities, voice-to-text transcription, data analytics and predictive tools, diagnostic imaging, smart wearables—you name it.

AI presents numerous potential applications within veterinary clinic workflow. From prescreening and triage to developing treatment plans and post-visit patient follow-ups, the technology promises to streamline processes and reduce the administrative burden on practitioners. With machine intelligence having garnered both enthusiastic proponents and vocal adversaries, the veterinary industry may soon find itself pondering a legal framework for regulating AI tools employed in animal healthcare.

Tod Drost, DVM, DACVR, executive director of the American College of Veterinary Radiology, argues1 that medical devices using AI should be subject to a regulatory oversight process like human medicine, emphasizing the importance of involving a neutral third party to prioritize patient interests in the development of these new technologies.

Another aspect is that the effectiveness of AI in veterinary medicine hinges on the technology's ability to tailor itself to the specific needs of the profession. Training machine-learning algorithms requires massive datasets, which, as of now, rely heavily on general AI models like ChatGPT. However, for AI to unlock its full potential in enhancing veterinary care, it is essential to secure access to verified medical data and knowledge bases, while actively engaging veterinary professionals in the process of training and fine-tuning these algorithms.

The

Consolidation rollercoaster

The veterinary consolidation market has been experiencing a period of overheated activity in recent years. Investments were pouring in, and consolidators were not just acquiring individual practices, but also other groups in a race to expand their networks. At its peak, corporatization had reached 25%, and practice valuation multiples were soaring to unprecedented levels. However, the year 2023 marked a turning point as the consolidation bubble burst. The once astronomical multiples plummeted from 18x to 8x. The arbitrage strategy that had fueled this rapid growth became no longer viable.

Several factors contributed to this stagnation. Postponed plans for an IPO by a major veterinary group due to regulatory hurdles,2 coinciding with high interest rates, inflation, and the inability of several large platforms to secure recapitalization left private equity firms increasingly wary of making new investments. Consequently, valuations across the board declined, impacting EBITDA multiples for consolidators, who found themselves grappling with oversized corporate teams, bloated overheads, and portfolios acquired at higher prices than their entire platforms were worth.

However, in 2024, we may see the recovery of the veterinary consolidation market. It has already started showing signs of activity, as evident in EQT's recent acquisition3 of VetPartners from JAB and NVA, as well as Petfolk’s4 and Bond Vet’s5 funding rounds. Innovative approaches are surfacing, such as de-novo (new build) models that offer a path forward with smaller-footprint practices and reduced upfront expenses. The market's trajectory hinges on the possibility of a significant IPO or a massive acquisition by a large player or substantial private equity firm.

While these developments could reset industry benchmarks, consolidators will need to adapt to survive. In a situation where there is a limit to arbitrage, it will be crucial to seek opportunities for margin expansion that align with the practitioners’ goals to care for patients. Transparency will be key to mending the tenuous relationships with independent practices.

Ryan Leech, BBA, director of strategic partnerships at Digitail, is an experienced leader with a history of growing businesses through highly scalable sales models. With a background that spans multiple industries, Leech led sales for startups that raised over $100M in funding and ran his own sales consulting firm. Today, as director of strategic partnerships at Digitail, he oversees collaborations and integrations with industry leaders and innovators to drive digital transformation in veterinary medicine.

In addition to his professional experience as director of business development at Galaxy Vets and Hippo Manager Software, Ryan is also the host of "The Bird Bath" and a former co-host of the "Consolidate That!" podcast.

References

- Lederhouse C. Artificial intelligence in veterinary medicine: What are the ethical and legal implications? American Veterinary Medical Association. October 4, 2023. Accessed October 26, 2023. https://www.avma.org/news/artificial-intelligence-veterinary-medicine-what-are-ethical-and-legal-implications

- FTC approves final order against JAB Consumer Partners to protect pet owners from private equity firm’s rollup of veterinary services clinics. Federal Trade Commission. October 14, 2022. Accessed October 26, 2023. https://www.ftc.gov/news-events/news/press-releases/2022/10/ftc-approves-final-order-against-jab-consumer-partners-protect-pet-owners-private-equity-firms

- EQT to acquire VetPartners, the leading provider of veterinary and animal health services in Australia and New Zealand. News release. EQT. October 11, 2023. Accessed October 26, 2023. https://www.prnewswire.com/news-releases/eqt-to-acquire-vetpartners-the-leading-provider-of-veterinary-and-animal-health-services-in-australia-and-new-zealand-301953072.html

- Petfolk raises $40M in Series B funding to continue the evolution of veterinary care. News release. Petfolk. October 19, 2023. Accessed October 26, 2023. https://www.prnewswire.com/news-releases/petfolk-raises-40m-in-series-b-funding-to-continue-the-evolution-of-veterinary-care-301961324.html

- Bond Vet receives $50 million funding round to further expansion. dvm360. October 17, 2023. Accessed October 26, 2023. https://www.dvm360.com/view/bond-vet-receives-50-million-funding-round-to-further-expansion

Articles in this issue

about 2 years ago

Veterinary industry trends to watch in 2024 (Part 1)about 2 years ago

National practice ownership network marks a year of growthover 2 years ago

Bond Vet receives $50 million funding round to further expansionNewsletter

From exam room tips to practice management insights, get trusted veterinary news delivered straight to your inbox—subscribe to dvm360.