COVID-19 has challenged businesses of all kinds across the country. Throughout the pandemic, veterinary practices have responded with innovative strategies to continue providing patient care, retain staff, maintain cash flow, and operate more efficiently — all while also donating personal protective equipment to our colleagues in human medicine and implementing strict guidelines to keep teams and clients safe.

Many veterinary business owners have made use of the federal government’s forgivable COVID-19 loan program, the Paycheck Protection Program (PPP). In fact, more than half of all US veterinary practices have benefited from PPP, according to data from the US Small Business Administration (SBA), which oversees the loans. This funding has played a key role in supporting veterinary care and keeping practices open during the COVID-19 pandemic.

Veterinary use of PPP: What the data show

AVMA analysts examined the SBA data on allocation of PPP funds as of July 6, and cross-referenced it with AVMA data on veterinary practices. Among the key findings:

- At least 18,657 veterinary hospitals — about 56% of practices nationwide — have used PPP loans as part of their strategy to maintain cash flow and keep their doors open during the pandemic.

- PPP loans have helped keep more than 200,000 veterinary team members working and caring for patients.

- More than 80% of the loans taken by the veterinary profession were for less than $150,000.

- PPP funds have been distributed among veterinary practices in all 50 states, plus the District of Columbia, Guam, Puerto Rico, and the Virgin Islands.

- Loans to veterinary practices totaled about $2.1 billion as of early July. Although the SBA data aren’t detailed enough to calculate the exact total, AVMA’s economists estimated it based on the range of SBA data, which made clear that the loans totaled at least $1.6 billion and possibly as much as $2.6 billion.

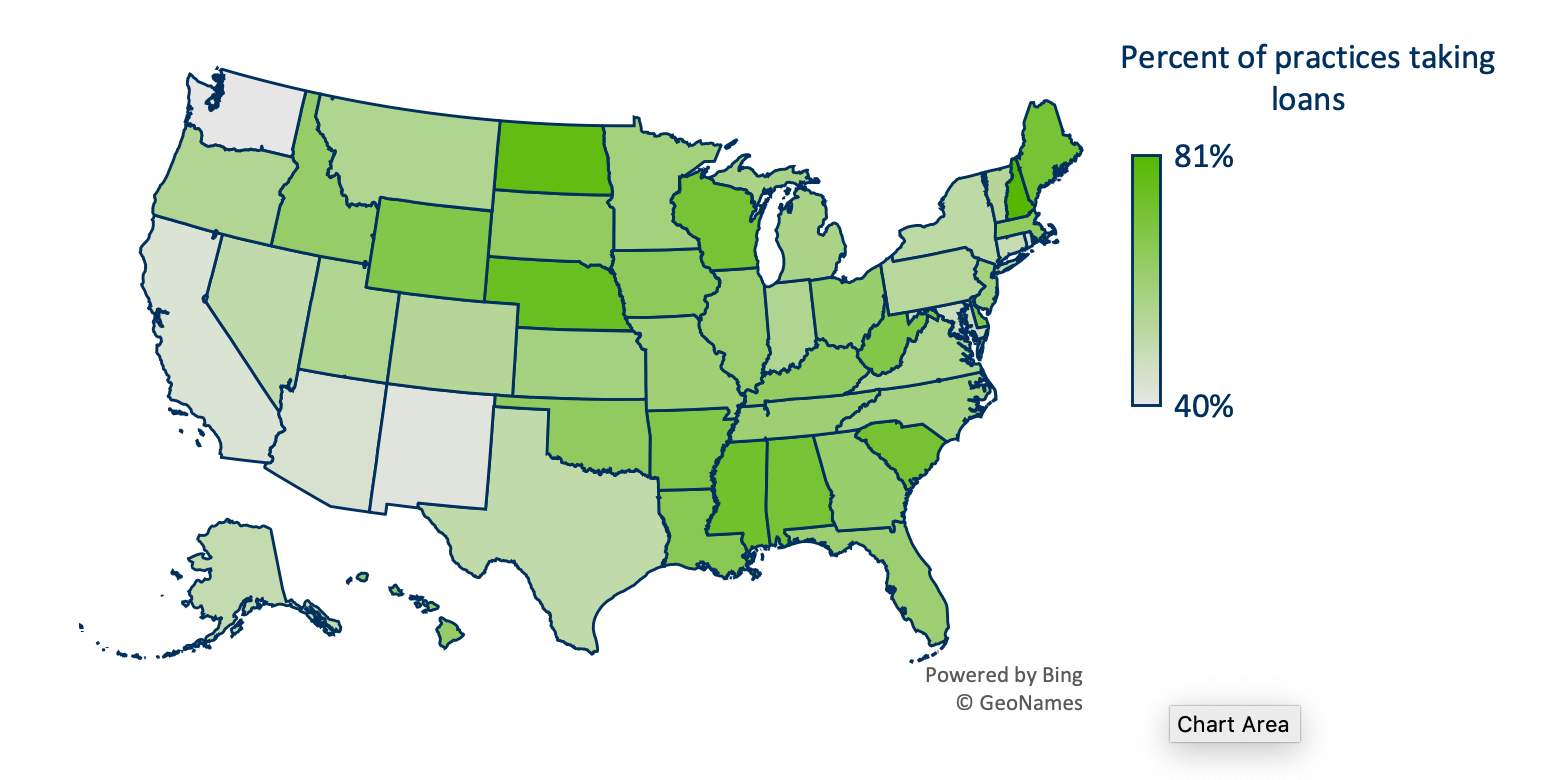

AVMA economists also looked at geographic differences in PPP loan use, and connected that with our own research into COVID-19-related business strategies for veterinary practices and data on the incidence of COVID-19 nationwide. Here’s what we saw:

- States with the highest rates of COVID-19 cases generally had higher rates of PPP loan borrowing.

- States that got hit with COVID-19 later generally had fewer practices taking out PPP loans — less than a 50% borrowing rate compared with 80% elsewhere. That means these states may need more support in the future.

PPP 101: The basics

PPP is a loan program for small businesses that was created to provide relief from the economic impacts of COVID-19. It offers forgivable loans to cover up to 24 weeks of qualified expenses, including payroll costs (up to $100,000 per employee), mortgage interest payments, rent, and utilities. To have loans forgiven, at least 60% of the money must be used for payroll costs. Borrowers can choose which non-payroll costs to submit for forgiveness.

The loans have a fixed interest rate of 1% for any amounts that aren’t forgiven. Payments on principal, interest, and fees are deferred until the SBA makes its forgiveness determination for each loan and notifies the lender. Interest will accrue during this time.

What’s next for loan forgiveness

When PPP was first introduced, most applications came from businesses in states that were being hit hardest by COVID-19 at the time. As infection rates increase in other states — particularly in the West and South — additional practices may need access to the forgivable loan offerings created by PPP.

The AVMA will continue to advocate for funding as circumstances require, so that veterinary practices will have access to these critical funds. We also are advocating for favorable tax treatment of PPP loan proceeds, and for a streamlined forgiveness process for loans below $150,000, which would include the vast majority of veterinary PPP loans. This is part of the work that AVMA’s government relations staff does to protect and promote the veterinary profession, and ensure the viability of veterinary practices, associates, and teams.

AVMA was instrumental in shaping PPP, and we continue to work on behalf of veterinary practices and teams to improve this program and others that support veterinary medicine. As I write this in early August, Congress is expected to pass another COVID-19 relief package, including measures that affect PPP. These could include additional funding and eligibility changes to the program.

Advice to those with PPP loans

For veterinarians who have taken a PPP loan, AVMA’s advice is to consider waiting to apply for loan forgiveness until after Congress decides whether to make additional changes to the program and additional SBA guidance is available.

Because policy discussions about PPP and the loan forgiveness criteria are ongoing, Congress may issue extensions and/or retroactive changes to the program. With loan repayment deferred until after you apply for forgiveness and the SBA rules on your eligibility, AVMA advises waiting to see whether the program rules continue to change. We also encourage you to remain in contact with your practice’s advisors as you explore the best options to seek forgiveness.

Other relief loans available

PPP isn’t the only loan program available to veterinary practices impacted by COVID-19. The SBA's Economic Injury Disaster Loan program provides small businesses with working capital to help overcome temporary revenue losses resulting from disasters. COVID-19 legislation expanded this program to provide for an advance of up to $10,000, distributed within 3 days, which can be used to cover payroll costs, rent, mortgage, and other obligations.

Need more information?

More information on both SBA loan programs can be found on AVMA’s COVID-19 resource center (avma.org/Coronavirus). AVMA regularly updates the page regarding the laws and regulations affecting veterinary small businesses, veterinarians, and veterinary students during the pandemic.

Dr. Salois is chief economist and director, and Rosemary Radich is the principal data scientist of the AVMA Veterinary Economics Division.