For most doctors, owning the facility offers the most benefits. Yet there are circumstances when renting may be smarter, especially if you're starting from scratch. Consider these issues to decide what's right for you.

For most doctors, owning the facility offers the most benefits. Yet there are circumstances when renting may be smarter, especially if you're starting from scratch. Consider these issues to decide what's right for you.

Here are the factors owners say they weigh most heavily when deciding about an associate's ownership potential.

How can I calculate client visitation and retention?

Paying equally doesn't always make sense in a partnership, especially when doctors aren't contributing in the same ways. A tiered-compensation system can account for these variances.

Is it OK to accept postdated checks when clients can't pay?

Of course, greater earning power and financial gain rank as important reasons for ownership. Yet there are more reasons to take this step. Here are some other benefits to owning a practice.

FLP requires both careful analysis and strict compliance with IRS regulations.

Forty percent of referrals to Deer Creek Animal Hospital in Littleton, Colo., come from pet stores, breeders, shelters, and rescue groups?that's 140 new clients a month.

Use this sample collection letter as a starting point as you work to control accounts receivable.

What tax rules apply to awards given to employees for service?

Does your accounts receivable make up more than 2.5 percent of your practice's yearly gross income if you're a small animal hospital and 4 percent to 5 percent if you're equine or large animal? If so, it's time to take action.

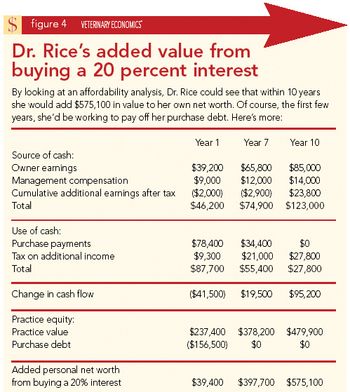

The numbers prove it: Selling a part interest to your associate boosts practice value and increases your net worth?plus, this step gives you a clear succession plan. Associates: You win with a buy-in, too.

What should I look for in an accountant?

A form to help you determine the costs of employment, such as health insurance, continuing education, dues, license, retirement programs, and payroll taxes.

About 45 to 55 percent of a doctor's time can be spent performing non-clinical duties.

The rising cost of health care is taking a bigger chunk of the pie when it comes to the total compensation employers pay to employees.

"Accounts receivable in most small animal hospitals should never exceed 2.5 percent of the yearly gross income. For equine and other large animal hospitals, 4 percent to 5 percent of gross revenue is the norm," says Gary Glassman, CPA, a Veterinary Economics Editorial Advisory Board member and partner with Burzenski and Co. PC in East Haven, Conn. Most practices struggle because they lack good procedures to ensure collection, he says.

I'm a bovine practitioner looking into ProSal compensation for my associates. I'm concerned with the percentage used to calculate the portion of the salary above the base. What percentage profit should a practice owner expect to make off of his associates?

As graduation approaches, my mind is a whirlwind of questions, concerns, and hopes. I'm ready to practice?mostly. Yet there's one topic that leaves me wary: salary. While production-based compensation and traditional salary historically have been the only two options, they each have room for improvement. But there's a third choice: the ProSal formula, developed by Hospital Management Editor Mark Opperman, CVPM. To understand why I think ProSal is right for me and other new associates, consider these pros and cons.

Relief veterinarians are typically treated as independent contractors responsible for their own income taxes and the reporting of their earnings and expenses. And most relief veterinarians conduct their practice activity as sole proprietors. Based on this, you'd report net income or loss from your relief practice on your personal income tax return. There are several important rules you should be aware of, however.

Projected increases in mortgage rates will likely lead to a drop in home sales in 2006, the Mortgage Bankers Association predicts.

The best of both worlds, the ProSal compensation formula pays associates on a percentage of production and guarantees a base salary. Find out why this method's a top choice for associates, and why you'll like it, too.

I work for a corporately owned, small animal practice on a production basis. We occasionally allow clients to make payments, and we accept checks. When a client doesn't pay or a check bounces, that amount's deducted from my monthly production total, and the client's turned in to a collections agency. If the company then receives payment, should I receive back payment for my services?

ORLANDO - 01/08/06 - Every professional practice should incorporate public relations in its marketing strategy. That was the message from Dr. Jim Humphries, whose experience when dealing with the media helped him spearhead the Veterinary News Network, a collaborative effort to represent veterinary medicine to local television and newspapers.

You're looking for improved profitability but could end up with high turnover and service breakdowns.

Q How should salary expenses for staff as a percentage of revenue differ for an emergency or 24-hour practice compared to a traditional practice?

I have an employee who regularly stays for overtime that I haven't authorized. My attorney says I have to pay her for the time, even though I didn't schedule it. What can I do to keep team members from working unapproved overtime?

... I knew this dog was more than an investment.

Starting this month, 401(k) plans can offer a Roth 401(k) provision?which could be a better option for your retirement savings.

Look beyond the price tag when you buy, then track usage and profitability carefully to make the most of your purchase.