If your burgeoning practice is making you claustrophobic, try these strategies to accommodate growth.

If your burgeoning practice is making you claustrophobic, try these strategies to accommodate growth.

When it's time to fix-up, remodel or redecorate the building, clinic or offices that house your veterinary practice, you will want to keep out-of-pocket expenditures to a minimum and recover as much of the funds spent as quickly as possible. Fortunately, both those veterinarians who own their own buildings and those who lease their property can take advantage of a variety of tax deductions, credits and other tax breaks to achieve those goals.

The U.S. Government Accountability Office (GAO) says that enhanced offerings, such as CD-ROMs and other instructional supplements, are driving up college textbook prices.

I'm a senior clinician getting a straight salary. My boss is changing my pay structure to base plus percentage. I'm nervous because often someone else does a workup and I'm stuck with a no-charge recheck, and sometimes we accept low-cost certificates, resulting in a lower charge.

Are your expenses dragging you down? Use this checklist to discover weak links in your finances.

Use these benchmarks set by Well Managed Practices to see how your expenses measure up.

Are you feeling the pinch of not enough revenue and too much expense? Don't wait until you hear crunching bones to make a move. There's no better time than now to start charming your practice to better financial health.

A retainer agreement should include a statement of hourly billing rates.

More than 88 percent of this year's new veterinarians graduated with educational debt averaging $88,077. Now working, they're taking home less than $44,000 a year.

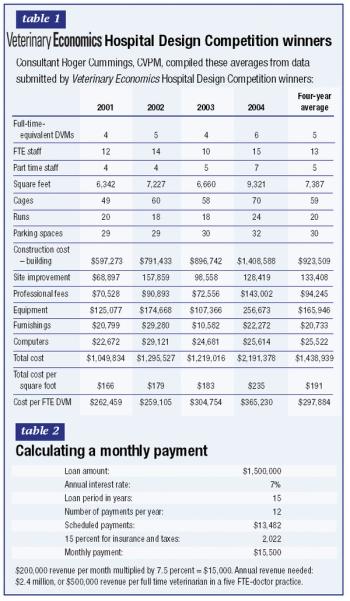

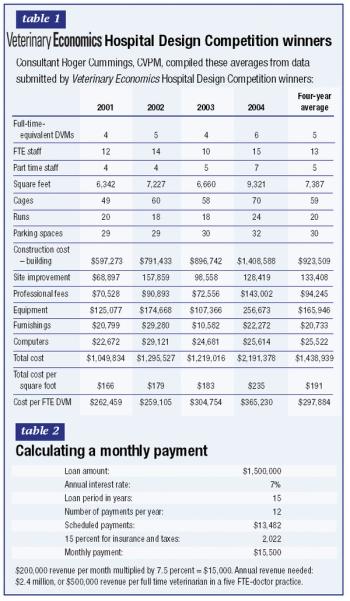

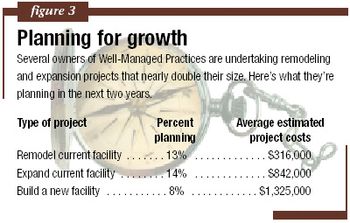

I'm considering building a facility. What average revenue growth can owners expect five and 10 years after building, adding onto, or remodeling a practice?

I'm considering building a facility. What average revenue growth can owners expect five and 10 years after building, adding onto, or remodeling a practice?

How are contracts for specialists different from contracts for generalists?

How do I know how much I need to save for retirement?

Reluctant to purchase high-tech equipment because you're concerned clients can't afford costly diagnostic tests? You may be right. But consider the following facts from the recent article "Putting on the Dog" from www.businessweek.com:

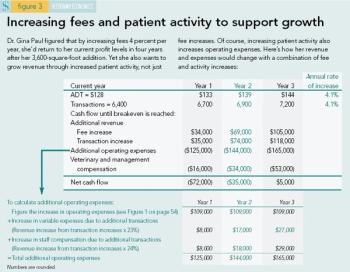

Raising fees isn't the only way to fuel revenue growth. Use these strategies to customize your revenue plan.

Practitioners charge too little because they cannot keep up with the literature.

Do you feel like you're always batting at your fees without ever pinning down the perfect fee schedule? Use this advice to align your fees with the level of client service and animal care you provide.

I perform services at a discount for a local nonprofit group. Can I write off the discounts?

Lynette Ott, the practice manager at Barton Heights Veterinary Hospital in Stroudsburg, Pa., always heard that 20 percent of clients bring in 80 percent of income. Not content to blindly adopt the mantra, Ott went looking for data.

If missed charges are slipping out the door, you may be seeing a smaller paycheck and fewer benefits—and you may find it harder to offer high-quality care.

What percent of practice revenue should go to food and products?

What's the expected average increase in gross income in the year after opening a practice?

How do you determine expected yearly production for veterinarians? How should it change based on years of experience?

I'm a full-time veterinarian, and my employer pays for my health insurance, which costs about $4,000 a year. I recently got married, and my husband's insurance is better. If I join my husband's policy, should I get that $4,000 benefit somewhere else in my package? Is it fair to ask my boss to add it to my salary or to add more paid vacation days in equivalent to the benefit money?

Q. I'm an associate veterinarian paid on a straight salary. My employer doesn't offer group health insurance as part of my contract, but I'd like him to pay my medical insurance premiums and those of my husband and son. I checked with the IRS, and it appears that he can pay the premiums for my family tax-free. If he offers me this benefit, does he have to offer it to everyone on salary?

The 2005 Well-Managed Practice Study shows how important strategic planning is to achieving your practice vision-and respondents say their only regrets are not planning sooner.

Being in your own business is working 80 hours a week so that you can avoid working 40 hours a week for someone else.

Well-managed practices realize they need to reinvest to keep their practices moving forward. Here's how they plan to leverage their facilities.

For 12 years, Dr. Steve Bishop and his crew at Animal Care Hospital in Phoenix have been tapping the retired population to make callbacks in the early evening. Doing so frees time for receptionists to work on other jobs, he says. "Plus, the hourly pay is less than for a receptionist, and the workers are more flexible with their time."

Taking the next big step in practice? Whether you're adding a doctor to the team, making the jump to partner, or taking on a remodeling or building project, we've got the right advice.