The changing dynamics of veterinary care

How COVID-19 prompted veterinary care to change and the new ways of the business that will remain in the post-pandemic world.

The US animal health industry has long been a global front-runner. Over the past few generations, our pets have made the move from the backyard to the couch to our beds. We have never been closer to our furry companions, and this has been reflected across the veterinary industry. Even with the global economic impact of COVID-19, the US veterinary industry rebounded strongly in the latter half of 2020, with industry sales data from the Veterinary Hospital Managers Association (VHMA) reporting revenue growth of 4.5% from 2019 to 2020.1 But how has COVID-19 changed the very dynamics of service delivery? Outlined below are the shifts that took place within weeks of the pandemic hitting and even with reopening’s—the new ways of doing business that are here to stay.

Curb-side appointments—the new normal

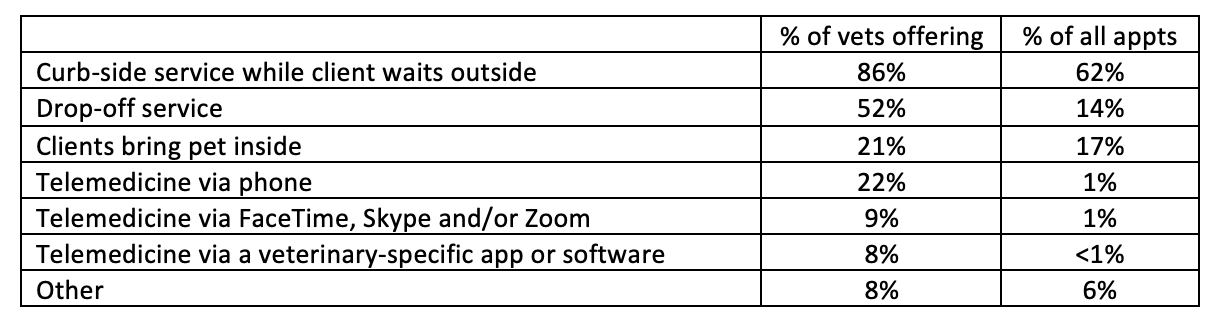

As with humans, essential medical care did not diminish during the pandemic; all our family animals with the usual ailments needed treatment. Although the purchase of essentials such as parasiticides and wormers shifted online, seeing the veterinarian in person remained a critical element of care. Given COVID-19 restrictions and social distancing requirements, the most impressive pivot by the industry was the almost immediate shift to curb-side appointments with staff collecting and treating pets while owners waited in cars. In a February 2021 Brakke survey, 86% of vets were still offering this service with it accounting for 62% of visits.2 The obvious safety and convenience of this new trend seem set to stay even as society returns to pre-pandemic norms. An interesting dynamic is that although 80% of vets believe owners will revert to in-clinic visits post pandemic, many owners are happier with curb-side service.

M/A/R/C Research with a sampling size of 1000 pet owners reported that 86% felt curb-side treatment went well or very well for their pets and 28% felt curb-side care went better than traditional in-clinic visits. The most significant data from this study points to the 48% of owners who would use curb-side after the pandemic has ended.3

Telemedicine—struggling to gain traction

For many years, the shift to telemedicine has struggled to gain traction and although the pandemic could have been the perfect storm to switch to telemedicine, veterinarians and owners have been slow to embrace these services. Although the same Brakke February 2021 research reported that 39% of vets were offering telemedicine either via phone/FaceTime/Zoom or a veterinary-specific app, less than 3% of clients used these services. This lack of uptake might seem obvious given the lack of verbal communication from animals, but it also appears pet owners need their animals to be examined in person by the veterinarian to feel they are receiving adequate treatment.

Source: Brakke Animal Health 2021 Animal Health Industry Overview

Online sales–a must-have solution for future veterinarians

The convenience of shopping from home continues to expand across all industries and retail segments. Online retailers have been particularly successful in understanding consumer behavior and tailoring marketing messages accordingly, resulting in high conversion rates. Meanwhile, the traditional costs of brick-and-mortar stores have been pumped into understanding and pursuing business online. In 2020, online veterinary product purchases by pet owners accelerated and although the health care requirement for essentials such as wormers and parasiticides has easily transitioned to online purchases, the more specialty prescription-only medicines have had to follow suit. This has resulted in more veterinarians writing scripts to be filled by online pharmacies and investing in their own online ordering and delivery platforms to fill this burgeoning need, with over half of practices now offering online ordering.

Brakke Consulting released an in-depth report in 2018 exploring online sales at small animal veterinary practices. This Veterinary Practice Home Delivery Report4 compiled data from more than 1100 respondents showing that:

- Half of independently owned practices operate an online store or pharmacy

- Online sales represent roughly 1% of the average independently owned practice’s annual revenues

This highlights the major opportunity for growth in the online segment as veterinarians learn to retain their clients and potential revenue streams within their practice, albeit online.

Competition is fierce

With many veterinary practices selling pet food and grooming and gifting products in addition to their pet pharmacy category, the competition has never been fiercer to retain revenues and satisfy the modern, tech-savvy client. The rise of Chewy, Inc—an American online retailer of pet food and other pet-related products—is a clear signpost that US clients want their pet products to have all the variety of choice and convenience they have come to enjoy in other areas of their retail lives. Chewy’s focus on customer experience and auto-ship of products took a leaf from the Amazon playbook and has paid off. Unlike many other companies that have suffered through 2020, Chewy has seen its stock price soar as individuals have shifted more heavily to online. Since the start of 2020, Chewy shares have jumped from about $30 to more than $67. Reporting in August 2020, the company saw net sales of $1.7 billion, a 47% increase over the same period in 2019.5 With myriad other online-savvy companies following suit, your local vet practice will need to upskill and invest in technology to stay in this market.

Industry challenges

Despite industry challenges and changes, the veterinarian remains central to pet health care but practices must adapt to keep pace with the strong demand for veterinary services. As most veterinary hospitals find themselves at capacity, price increases are inevitable and Animalytix is projecting increases of between 7% and 9%.6 A continued shortage of registered veterinarians and qualified employees will push wages upward, putting pressure on practice margins and profitability. Growing online revenue streams provide an opportunity for increasing revenue and creating passive income that can be reinvested to develop the health care services.

The future

One thing is certain from the strong performance of the animal health industry over the past 10 years and its ability to rebound in a post pandemic era: pets are now part of the family, and their health care has become a physical, emotional, and financial priority.

Louise Grubb is the founder and chief executive officer of TriviumVet, which was named one of the top 100 start-ups in Ireland in 2020 and 2019. She has more than 20 years’ experience in the veterinary and pharmaceutical industries. Her previous roles include founder of NutriScience, a global developer and supplier of dietary and wellness supplements for animals, and founder of Q1 Scientific, a firm specializing in the stable storage of human and veterinary pharmaceutical products. In 2016, she was a finalist in the Ernst & Young Entrepreneur Of The Year Awards while leading Q1 Scientific.

References

- Veterinary Hospital Managers Association. Insiders Insight Benchmark Report. https://cdn.ymaws.com/members.vhma.org/resource/resmgr/insiders__insight_-_2021/VHMA_Insiders_Insight_Januar.pdf. Published December 2020. Accessed July 9, 2021.

- Brakke Consulting. 2021 Animal Health Industry Overview. Published February 23, 2021. Accessed via webinar February 23, 2021.

- Animalytix, LLC. Lessons Learned in a Disrupted Marketplace; How COVID is Shaping the Veterinary Channel. Published February 16, 2021. Accessed via webinar February, 16 2021.

- Brakke Consulting, The Veterinary Practice Home Delivery Report. https://todaysveterinarybusiness.com/brakke-report-examines-hospitals-internet-sales/. Published June 2018. Accessed March 1, 2021.

- Wile, R. There’s a $30 billion company in South Florida. It wants to take over the pet world. Miami Herald. https://www.miamiherald.com/news/business/biz-monday/article246143765.html. Published October 19, 2020. Accessed March 1, 2021.

- Animalytix, LLC. Animlaytix 2021 Senior Executive Forum. 2021 Key Expectations & Projections by Katz, Sapper & Miller. Published February 16, 2021. Accessed via webinar February 16, 2021.